Nvidia, once celebrated as a titan in the tech industry, has recently been dethroned from the prestigious $3 trillion market capitalization club, leaving only Apple as its sole occupant. The stock’s declining trajectory became alarmingly evident following its quarterly earnings report, which led to an over 8% plunge in share value, translating to a staggering loss of $273 billion in market capitalization. As of now, Nvidia stands at approximately $2.94 trillion. This significant drop reflects broader market dynamics, as the S&P 500 index and the Nasdaq composite also faced declines of 1.6% and 2.8%, respectively.

Despite this setback, Nvidia remains the second most valuable tech company in the United States, only trailing behind Apple and maintaining a lead over Microsoft, which relies heavily on its chips. However, throughout 2025, Nvidia shares have deteriorated by 10%, largely driven by investor anxieties surrounding export controls, tariffs, the emergence of more efficient artificial intelligence models, and a general deceleration in growth rates.

It’s essential to contextualize Nvidia’s decline within its recent performance metrics. The company reported exceptional earnings on Wednesday, surpassing expectations across the board. Revenue surged an impressive 78% year-over-year, reaching $39.33 billion. A noteworthy highlight was the data center revenue, which encompasses its leading graphics processors tailored for AI applications, experiencing a staggering annual growth of 93%, nearing $36 billion.

These figures underscore a paradox; despite immediate investor concerns, Nvidia’s financial foundation remains robust, with revenue levels five times higher than two years ago when generative AI began to take the tech world by storm. Notably, the company achieved a remarkable market cap of $3 trillion for the first time in June 2024, signaling its previous dominance in the AI sphere.

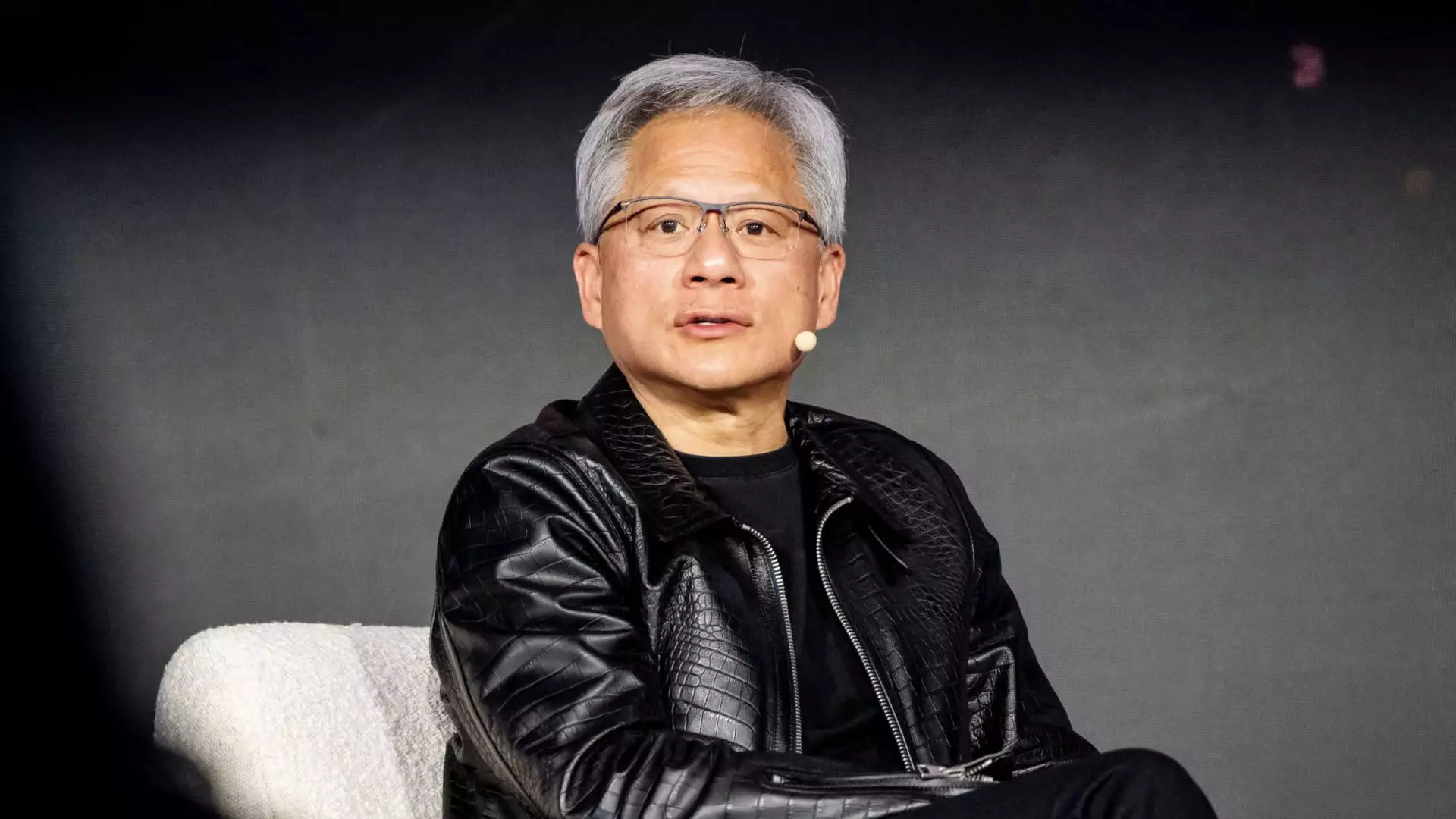

Looking ahead, Nvidia has maintained an optimistic outlook. CEO Jensen Huang recently asserted that the demand for its chips is poised for continued growth. He emphasized that emerging AI models which require more sophisticated reasoning will need exponentially more processing power, signaling a future filled with potential. Huang remarked that the computational demands of next-generation AI — which utilize intricate reasoning processes — are projected to require 100 times the resources previously utilized.

As large cloud service providers such as Microsoft, Google, and Amazon account for approximately half of Nvidia’s data center revenue, the continued infrastructure investments by these industry giants remain crucial for Nvidia’s financial success. Despite the uncertainties in the tech landscape, Nvidia’s stronghold in the AI sector appears firm, provided it navigates market challenges adeptly.

While Nvidia struggles with market volatility and investor apprehensions, its foundational growth and strategic direction in the world of AI technology could pave the way for recovery. The company’s ability to adapt to the swiftly changing landscape will be paramount as it seeks to reclaim its place in the upper echelon of the tech sector.

Leave a Reply