As investors prepare for the trading day, several pivotal factors and events require close attention. From stock market performance to significant corporate developments and broader economic metrics, understanding these elements can shape investment decisions. This article explores these critical aspects, providing insights into market trends, corporate actions, and overarching economic indicators.

The recent performance of the S&P 500 reveals a positive momentum that investors should not overlook. Marking its fourth consecutive day of gains, the index rose by 0.75%, suggesting a robust level of investor confidence in the overall market. The Nasdaq Composite outpaced its peers with a significant increase of 1%, fueled primarily by a surge in technology stocks—a sector that historically drives market growth. This trend indicates a renewed enthusiasm for tech investments, boding well for related companies. Meanwhile, the Dow Jones Industrial Average also contributed positively with an increase of 235.06 points, equivalent to 0.58%.

One must consider the implications of these movements. As the S&P 500 continues its upward trajectory, it may reflect bullish sentiment among investors, leading to increased trading activity. Keeping an eye on market trends can aid in identifying the right timing for entering or exiting positions.

Inflation Data: A Precursor to the Federal Reserve’s Decisions

An important catalyst for market movements this week is the release of the latest Producer Price Index (PPI) data. This report serves as a gauge for inflation trends, featuring a 0.2% increase in wholesale prices for August, aligning with expectations. The inflation metrics are particularly significant as they precede an upcoming Federal Reserve meeting, where interest rate discussions are likely to take center stage. Investors are urged to analyze how these inflation indications may influence the Fed’s monetary policy in the near future.

Increased inflation could prompt the Fed to implement rate hikes, affecting borrowing costs and potentially slowing economic growth. Conversely, stable inflation may support a more accommodative policy approach, which can further buoy market confidence. Hence, following these economic reports closely is essential for making informed investment choices.

In the corporate realm, Boeing faces substantial challenges as more than 30,000 of its workers initiated a strike following the rejection of a tentative contract agreement. This industrial action stems from dissatisfaction among factory employees represented by the International Association of Machinists and Aerospace Workers. The strike could lead to production halts for Boeing’s most popular aircraft models, showcasing the significant impact labor relations can have on operational capabilities.

Boeing’s commitment to addressing employee relations and re-engaging in negotiations is crucial for the company’s recovery, particularly after encountering numerous operational missteps. The unfolding situation may have ripple effects on supply chains and overall production timelines, which investors should monitor closely.

Corporate Earnings: Adobe’s Mixed Results

Turning to corporate earnings, Adobe reported third-quarter results that, while surpassing analysts’ expectations for both sales and earnings, led to a notable decline in its stock price during premarket trading. With a drop of about 8%, the market reacted sharply to the company’s fourth-quarter forecasts, which fell short of analyst projections. These developments underscore the balancing act that companies face: delivering strong current performance while managing future expectations.

Adobe reported a year-over-year subscription revenue increase of 11%, demonstrating resilience in its core business. However, investor focus on forward guidance indicates that future projections carry significant weight in determining market valuations. Analyzing not just current earnings but also outlooks is essential for discerning long-term investment potential.

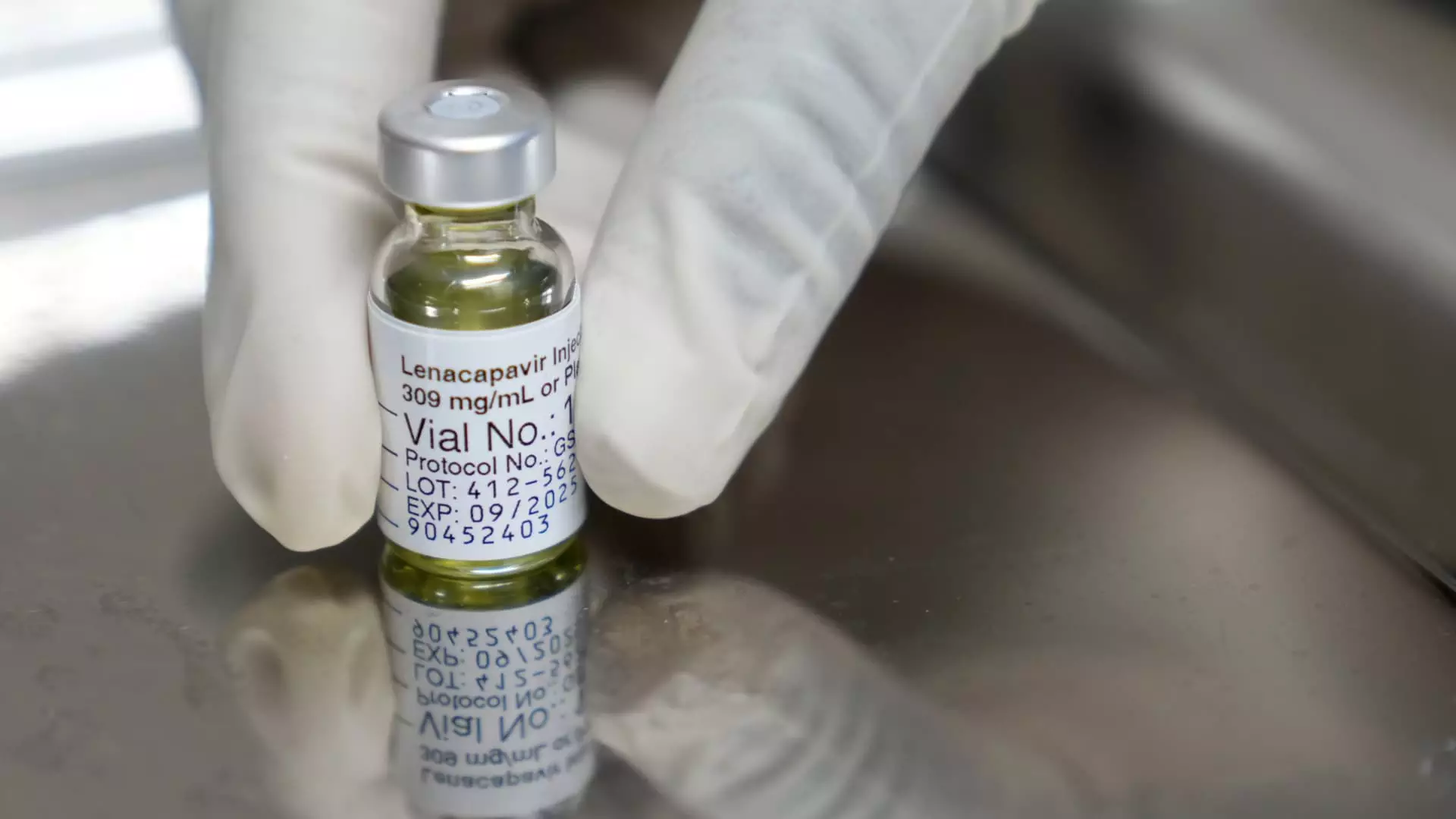

Healthcare Breakthroughs: Gilead’s Promising HIV Treatment

In a noteworthy advancement for the healthcare sector, Gilead’s recent trial data for lenacapavir—a twice-yearly injection that significantly reduces HIV infections—has shown promising results. With a staggering 96% reduction in infections noted among trial participants, the new medication seems poised for regulatory approval, potentially transforming HIV prevention strategies in the U.S.

Such breakthrough findings typically attract considerable attention from investors, especially in biotech and pharmaceutical stocks. As companies often respond swiftly to successful clinical outcomes, the implications for Gilead’s stock performance and overall market sentiment toward innovative healthcare solutions should not be underestimated.

Legal Maneuvering: Tapestry and Capri’s Proposed Merger

Lastly, the ongoing legal proceedings surrounding the proposed merger of Tapestry, the parent company of Coach, and Capri Holdings, known for Michael Kors, offers insight into the intricacies of corporate mergers and regulatory scrutiny. With the Federal Trade Commission (FTC) challenging the merger on grounds of potential harm to market competition, the outcome could significantly impact the retail and fashion sectors.

Investors must track the implications of these legal hurdles—not only for the companies involved but also for broader market competition and pricing dynamics within the handbag industry. Understanding the competitive landscape formed by both mergers and antitrust regulations can be crucial for investment strategies.

As trading begins anew, a comprehensive awareness of these prevailing insights will empower investors. Whether it’s market movements, key economic indicators, corporate earnings, or significant industry developments, being informed can foster strategic decision-making in a dynamic trading landscape.

Leave a Reply