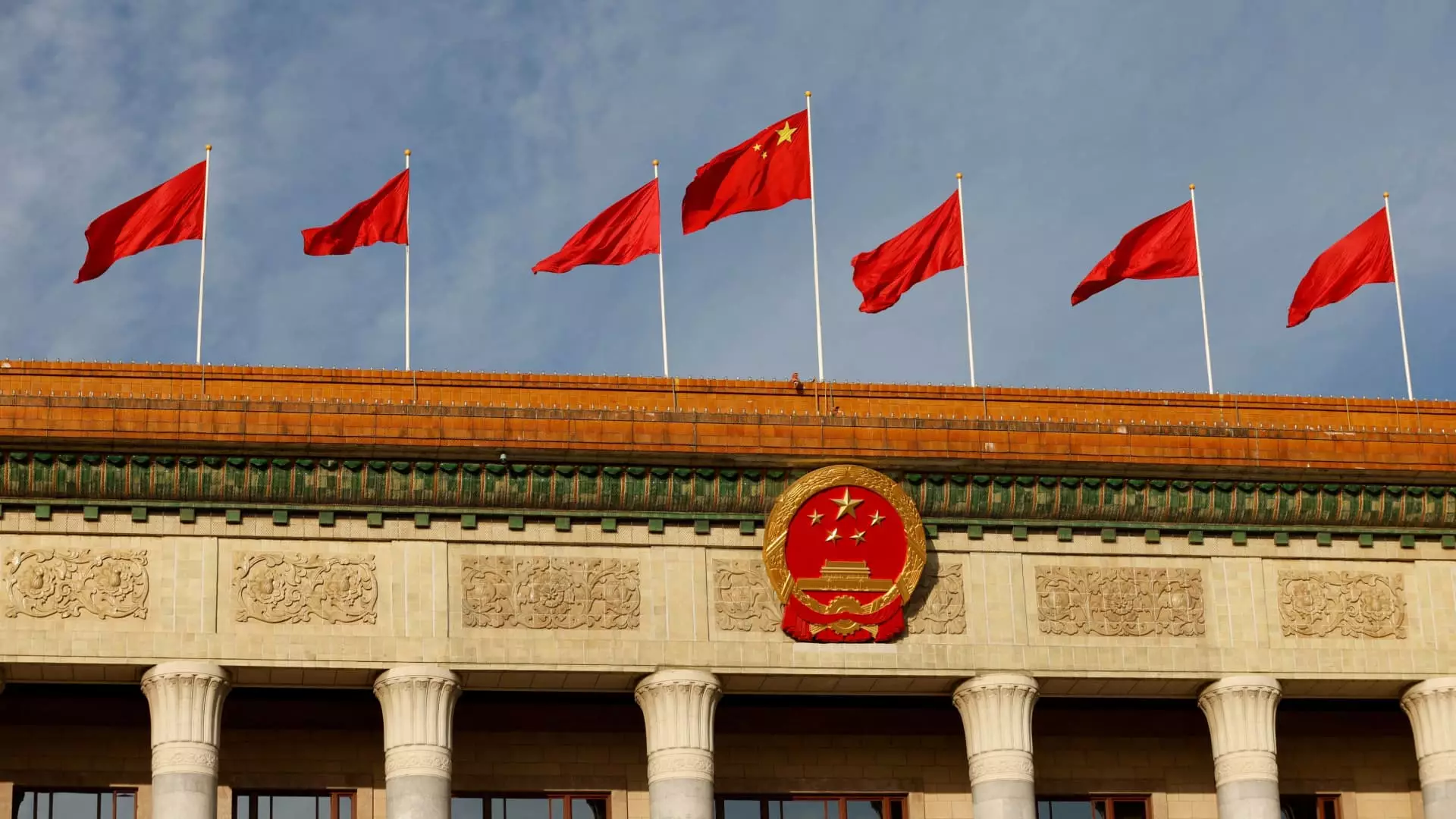

China is gearing up for its annual parliamentary meetings, known as the “Two Sessions,” which provide valuable insights into the country’s economic policy and plans for the upcoming year. Investors are closely monitoring these meetings to gauge the potential for economic stimulus in light of the challenges faced by the Chinese economy.

Despite China’s GDP growing by 5.2% in 2023, the overall recovery from the Covid-19 pandemic has been slower than anticipated. Factors such as a prolonged slump in the real estate market and declining global demand for Chinese exports have contributed to low consumer and business sentiment. This has raised questions about whether Beijing will intervene with substantial support measures.

Authorities in Beijing have been cautious in signaling their intentions regarding economic stimulus. Chief economist Wang Jun from Huatai Asset Management stated that any new policy support would be “appropriate” and emphasized that the scale of stimulus would not match the magnitude of measures implemented in 2008. This conservative approach reflects Beijing’s focus on prudential economic management.

In the upcoming Two Sessions meetings, policymakers are expected to address crucial areas such as the real estate sector, capital markets, and local government finances. This aligns with China’s efforts to mitigate financial risks and reduce the reliance of real estate developers on excessive debt for growth.

As China prepares to unveil its targets for GDP, employment, and other economic indicators, experts anticipate that the country’s fiscal deficit target will be around 3.5%. Moreover, monetary policy is expected to remain relatively loose, reflecting a strategy to support economic growth.

The Two Sessions provide a platform for discussing policy changes and plans to bolster technological innovation, aligning with China’s emphasis on advancing “new productive forces.” While policymakers may hint at opening up borders and creating opportunities for foreign businesses, specific implementation details are likely to be announced by individual ministries.

Despite the challenges faced by the Chinese economy, analysts expect a gradual recovery in the coming year. Wang from Huatai Asset Management anticipates an improvement in nominal GDP compared to real GDP, which could contribute to a more tangible recovery for consumers and businesses.

China’s Two Sessions serve as a critical juncture for policymakers to address economic challenges, set policy directions, and provide clarity on stimulus measures. The cautious approach adopted by Beijing underscores the government’s commitment to sustainable economic growth and financial stability. As the world closely observes China’s economic policy decisions, the outcomes of the Two Sessions will have significant implications for global markets and investors.

Leave a Reply