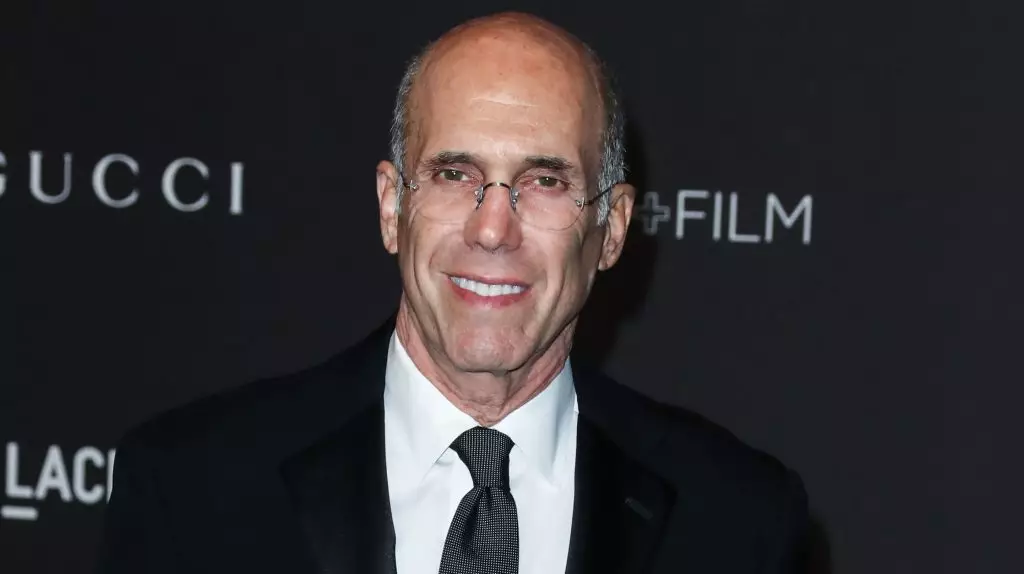

In the current Hollywood landscape, there is a lot of buzz surrounding the potential for a Paramount-Skydance deal. Jeffrey Katzenberg, a prominent figure in the industry, has expressed his support for such a deal, stating that it would be a great win for Paramount and the people in the industry. However, he also acknowledged the complexity of the situation, noting that the previous David Ellison deal did not come to fruition. This raises questions about the feasibility of a successful outcome for Paramount.

One of the major challenges highlighted in the analysis is the economic complexity that has played out over decades in the industry. This complexity makes it difficult to navigate towards a successful deal, although Katzenberg remains optimistic that it is not impossible. The failed David Ellison deal serves as a cautionary tale, showing that ambition and enthusiasm for the movie business may not always translate into a successful partnership.

Despite the exclusive negotiating window ending, Paramount is still in talks with David Ellison, as well as engaging with a rival bidding team of Sony and Apollo. The Sony-Apollo offer presents a tempting proposition with more money for shareholders, but it also comes with its own set of regulatory risks. The idea that Apollo would take on broadcast assets raises concerns about FCC approval, given the stringent regulatory environment in the industry.

The Controlling Shareholders’ Dilemma

Another option on the table is for Paramount’s controlling shareholders, such as Shari Redstone, to decide to sit tight and not pursue either deal. This alternative route would involve a buyout of Redstone’s stake by Ellison and backers, with the company remaining together and public. While this scenario may appeal to some stakeholders, it also raises questions about the long-term viability of Paramount in the rapidly changing entertainment landscape.

The Hollywood Perspective

From a broader Hollywood perspective, there is a sense of anticipation and uncertainty surrounding the potential outcomes of the current deal situation. The $26 billion offer from Sony and Apollo to acquire the whole company and take it private has garnered interest from shareholders, but the complex regulatory landscape and the challenges of integrating broadcast assets pose significant hurdles for the deal to materialize.

The analysis of the current Hollywood deal situation reveals a nuanced and multifaceted landscape filled with opportunities and challenges. The outcome of the Paramount-Skydance deal and the involvement of key players such as David Ellison, Shari Redstone, and Sony and Apollo will shape the future of the entertainment industry. As stakeholders navigate through the economic complexities and regulatory risks, it remains to be seen whether a successful deal will be reached, or if alternative paths will be explored in the ever-evolving world of Hollywood business.

Leave a Reply