The recent polling data revealed an interesting insight into the public perception of the tax policies of the Conservative and Labour parties. According to the research conducted by Savanta, the majority of respondents expressed skepticism towards the promises made by both parties regarding tax hikes. It is concerning that 41% of the participants outright stated that they do not believe either party when it comes to pledges about major taxes such as income tax, national insurance, and VAT. This lack of trust could have significant implications for both parties as they strive to secure support for their policies.

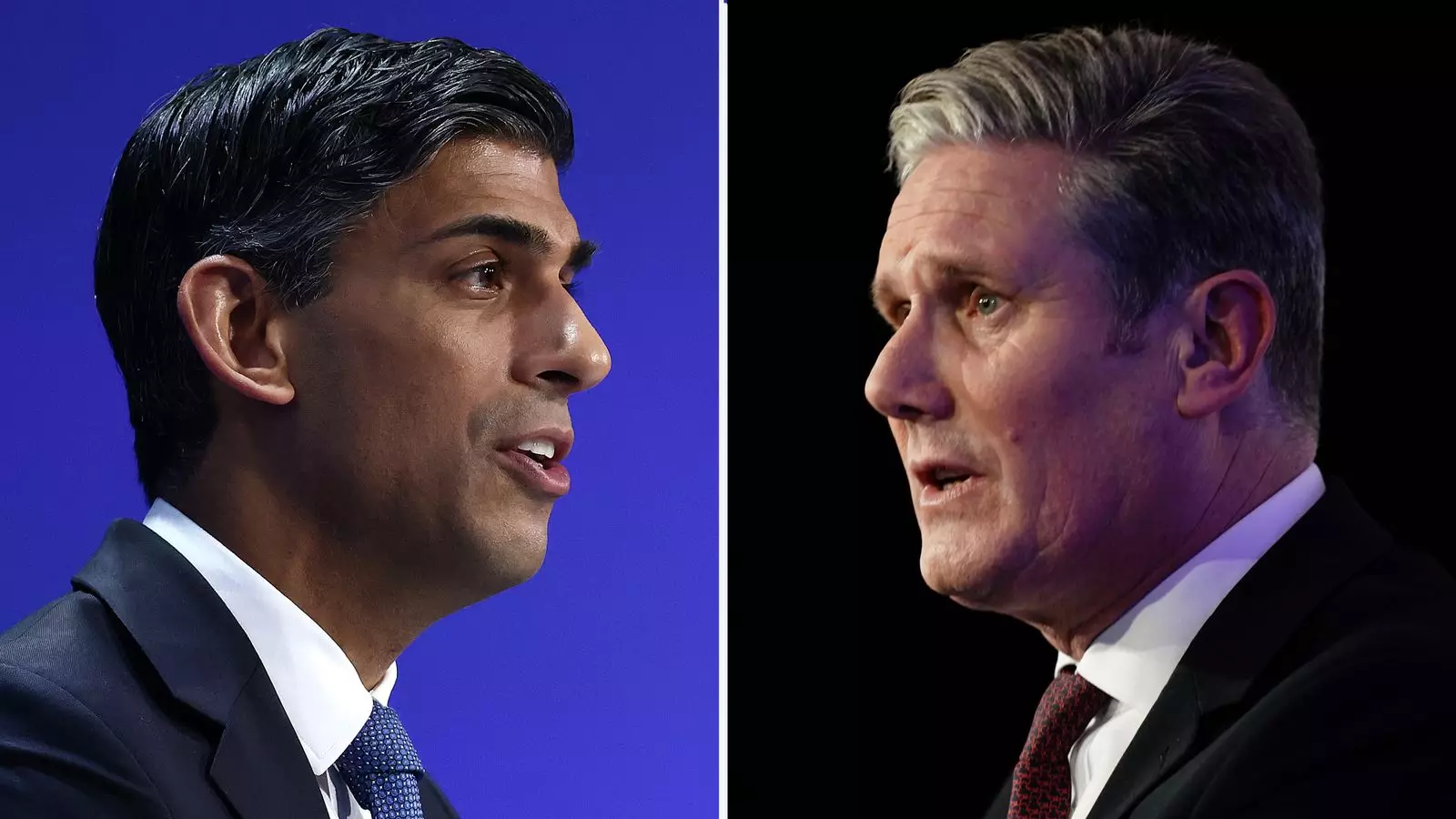

The survey results indicated that there is a disparity in the level of trust placed in key political figures regarding tax policies. Only one in six respondents believed that Rishi Sunak, the Conservative Chancellor, would not raise major taxes. In contrast, one in four individuals expressed confidence in Sir Keir Starmer, the leader of the Labour Party, when it comes to tax commitments. This discrepancy in trust highlights the challenge faced by the Conservative Party in convincing the public of their tax proposals, especially in comparison to their political rivals.

The issue of tax policy was brought to the forefront during the first TV debate between Rishi Sunak and Sir Keir Starmer. Mr. Sunak repeatedly emphasized the potential tax implications of Labour’s plans, claiming that it would require significant annual tax increases for families. In response, Sir Keir dismissed these claims as baseless and unwarranted. The heated exchange during the debate shed light on the contrasting views of the two parties regarding taxation, further adding to the public’s skepticism and confusion surrounding the issue.

Transparency and Accountability

The debate surrounding tax policy has also raised concerns about the transparency and accountability of the information provided by both parties. The Prime Minister’s assertion of a £38.5 billion deficit over four years was met with scrutiny, with Labour questioning the validity of the calculations. Additionally, revelations from the Treasury’s chief civil servant highlighted discrepancies in the costings attributed to independent sources rather than impartial assessments. This lack of clarity and consistency in presenting financial information undermines the credibility of both parties in the eyes of the public.

Impact on Voter Behavior

The polling data revealed that individuals aged over 55, a key voting demographic, were the most skeptical of both parties’ promises regarding tax policies. This group, which is traditionally seen as crucial for the Conservatives, expressed doubts about the credibility of the tax commitments made by the political leaders. The findings suggest that the issue of tax policy could significantly influence voter behavior, especially among older voters who hold significant sway in the outcome of elections.

The public perception of tax policies presented by the Conservative and Labour parties is characterized by skepticism, mistrust, and confusion. The lack of transparency, accountability, and consistency in communicating financial information has contributed to the prevailing doubts among voters. As the election approaches, both parties will need to address these concerns effectively to regain the trust and confidence of the electorate. Failure to do so could have far-reaching consequences for their electoral prospects and overall credibility in the eyes of the public.

Leave a Reply