Nvidia has reached a significant milestone with its shares surpassing $1,000 for the first time in extended trading, following the release of its fiscal first-quarter results that exceeded analyst expectations. This achievement reflects the ongoing momentum of the AI boom, which has captured the attention of investors worldwide. The company’s robust performance in the first quarter indicates a sustained demand for its AI chips, with CEO Jensen Huang predicting revenue from its next-generation chip, Blackwell, later this year. Notably, the stock rose by 7% in extended trading, signaling a positive outlook for Nvidia moving forward.

In terms of financial metrics, Nvidia reported an adjusted Earnings Per Share (EPS) of $6.12, beating the consensus estimate of $5.59 by LSEG. Additionally, the company’s revenue totaled $26.04 billion, surpassing the expected $24.65 billion. Looking ahead, Nvidia anticipates sales of $28 billion in the current quarter, demonstrating confidence in its ability to continue delivering strong financial results. The significant increase in net income from $2.04 billion to $14.88 billion showcases the company’s exceptional performance and growth trajectory.

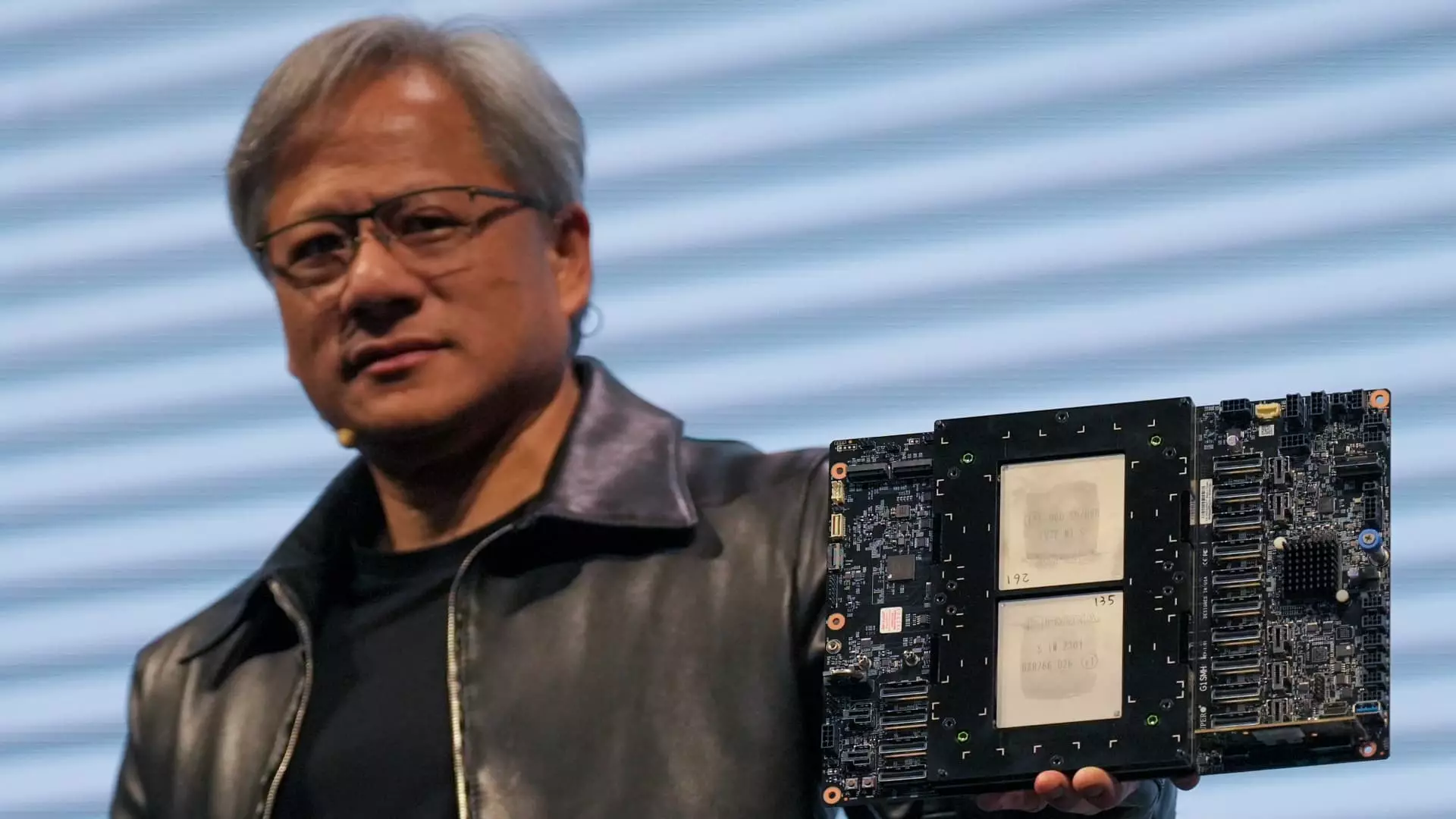

A key driver of Nvidia’s success is its data center business, which saw a remarkable 427% increase in revenue to $22.6 billion. This growth was fueled by strong demand for the company’s AI chips, particularly the Hopper graphics processors, including the H100 GPU. Notable partnerships with tech giants like Meta, who utilized 24,000 H100 GPUs for their latest language model, Lama 3, underscore Nvidia’s position as a top supplier in the AI space. With large cloud providers contributing a significant portion of data center revenue, Nvidia’s leadership in this sector is solidified.

While Nvidia is renowned for its data center sales, the company continues to excel in other areas such as gaming, networking, professional visualization, and automotive sectors. Gaming revenue increased by 18% to $2.65 billion, driven by strong consumer demand. The networking segment also experienced substantial growth, with $3.2 billion in revenue primarily from InfiniBand products. Nvidia’s professional visualization and automotive sales, although smaller compared to data center revenue, reflect its commitment to diversification and innovation.

In terms of capital allocation, Nvidia repurchased $7.7 billion worth of shares and paid $98 million in dividends during the quarter, highlighting its dedication to enhancing shareholder value. The company’s decision to increase its quarterly cash dividend from 4 cents per share to 10 cents, post-split, shows confidence in its financial position and future prospects. This proactive approach to capital distribution reinforces Nvidia’s commitment to long-term sustainability and growth.

Nvidia’s exceptional financial performance, driven by strong demand for its AI chips, data center dominance, diversification strategies, and shareholder-friendly initiatives, positions the company as a leader in the technology and semiconductor industries. With a clear focus on innovation, strategic partnerships, and delivering value to stakeholders, Nvidia is poised for continued success in the evolving digital landscape.

Leave a Reply