In the ever-evolving landscape of the stock market, the right picks can mean the difference between monumental gains and dismal losses. Recently, Bank of America put a spotlight on several stocks that it asserts are primed for significant growth. In this article, I will delve deep into these selections and offer a critical perspective that underscores both their potential and the broader implications for investors.

Netflix: The Streaming Juggernaut with Unmatched Resilience

If you’re looking for a stock that exemplifies strength in a volatile market, Netflix is the primary candidate. Analyst Jessica Reif Ehrlich’s recent upward adjustment of Netflix’s price target to $1,490 per share—from $1,175—is a testament to its robust performance and strategic positioning. With a staggering 39% increase this year, Netflix has showcased its resilience, fueled by continuous subscriber growth and the company’s impressive earnings momentum.

But let’s be real: can we trust that Netflix will maintain this momentum in a rapidly changing entertainment landscape? The company is certainly making strides in enhancing its advertising technology, a move that seems to be a panacea for its revenue diversification. However, the mere act of playing catch-up in the advertising realm isn’t without risks. With competitors like Disney+ and HBO Max carving out their own spaces in the streaming wars, it raises questions about whether Netflix’s current lead can hold ground. It’s one thing to foresee strong growth; it’s entirely another to execute strategies that ensure that growth continues in a competitive environment.

Amazon: Robotics and E-commerce Reimagined

In an age where efficiency is king, Amazon continues to elevate its status as a dominant market force. Analyst Justin Post’s optimistic forecast, raising Amazon’s price target to $248 per share, hinges upon the transformative role robotics and drones will play in their operations. The prospect of reducing labor dependency and improving warehouse efficiency is undeniably appealing, particularly as labor costs continue to rise across various sectors.

However, it’s imperative to scrutinize the underlying assumptions of this rosy outlook. While the adoption of robotics promises to enhance efficiency, it also opens a Pandora’s box of ethical and economic implications. The potential displacement of workers raises serious concerns, casting a shadow on Amazon’s approach to achieving profitability. Society is already grappling with the fallout from automation, and companies like Amazon must tread carefully to balance innovation with social responsibility. How will Amazon navigate public sentiment as their workforce transformed into machines?

Boot Barn: A Western Investment Trend Worth Watching

Boot Barn, a company that thrives on the quintessential American cowboy aesthetic, is enjoying a growth spurt, as suggested by analyst Christopher Nardone’s price target increase to $192 per share. Nardone’s faith in the brand stems from their broad-based improvements across merchandise categories and geographic areas. The company’s success in cultivating a friendly pricing environment provides further credence to the assertion that Boot Barn could capture significant market share.

Yet, I can’t help but feel skeptical about the sustainability of such growth. The Western-themed niche is specialized and encounters risks tied to fluctuating consumer interests. Is the resurgence of interest in cowboy culture a fleeting trend, or is it here to stay? Additionally, the potential for market saturation in this segment should not be overlooked. As other companies take aim at this market, Boot Barn must constantly innovate to remain relevant and maintain its edge.

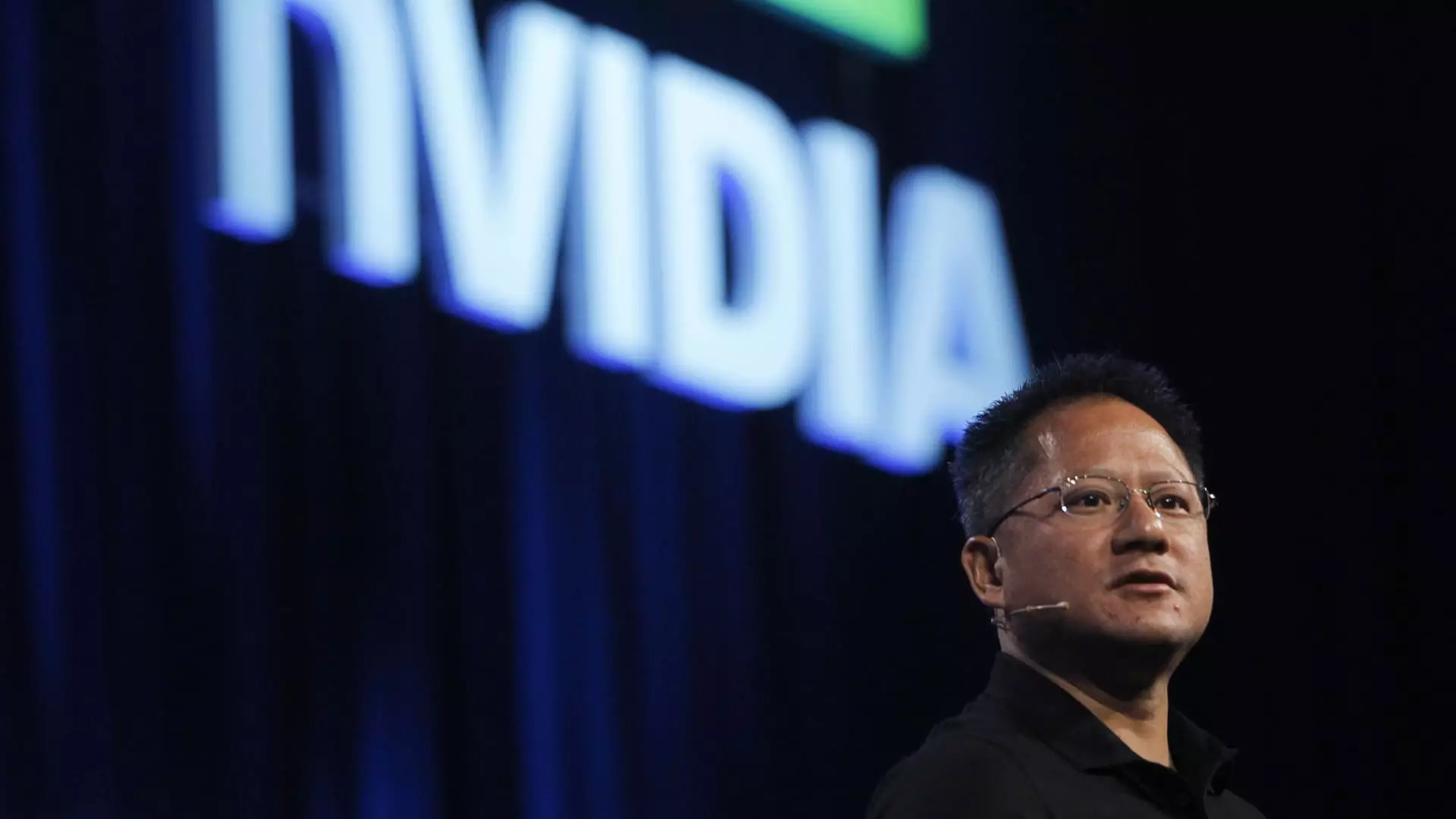

Nvidia: Riding the AI Wave

Among the more audacious predictions, Nvidia has been touted as a top pick due to its pivotal role in the burgeoning artificial intelligence sector. Analysts point to its established dominance and robust performance in AI-related products, with a price target of $180 per share. The notion that Nvidia is on the cutting edge of AI technologies is compelling, but it begs the question: how long can this excitement last?

Investors should tread cautiously; the hype surrounding AI, while palpable, is often built upon speculative forecasts. Furthermore, the tech sector has shown us time and again that trends can shift rapidly, and even the most well-established companies can falter if they fail to adapt. The excitement is justified, but reliance on past performance can lead to disillusionment if the expected waves of growth don’t manifest.

With Bank of America’s assortment of stock picks, it’s clear there are dynamic opportunities on the horizon. However, lurking beneath the surface of robust forecasts and price targets are the realities of competition, sustainability, and the ever-present unpredictability of market forces. Investors must approach these recommendations with a discerning eye, understanding that while potential exists, so do pitfalls that could impede progress.

Leave a Reply