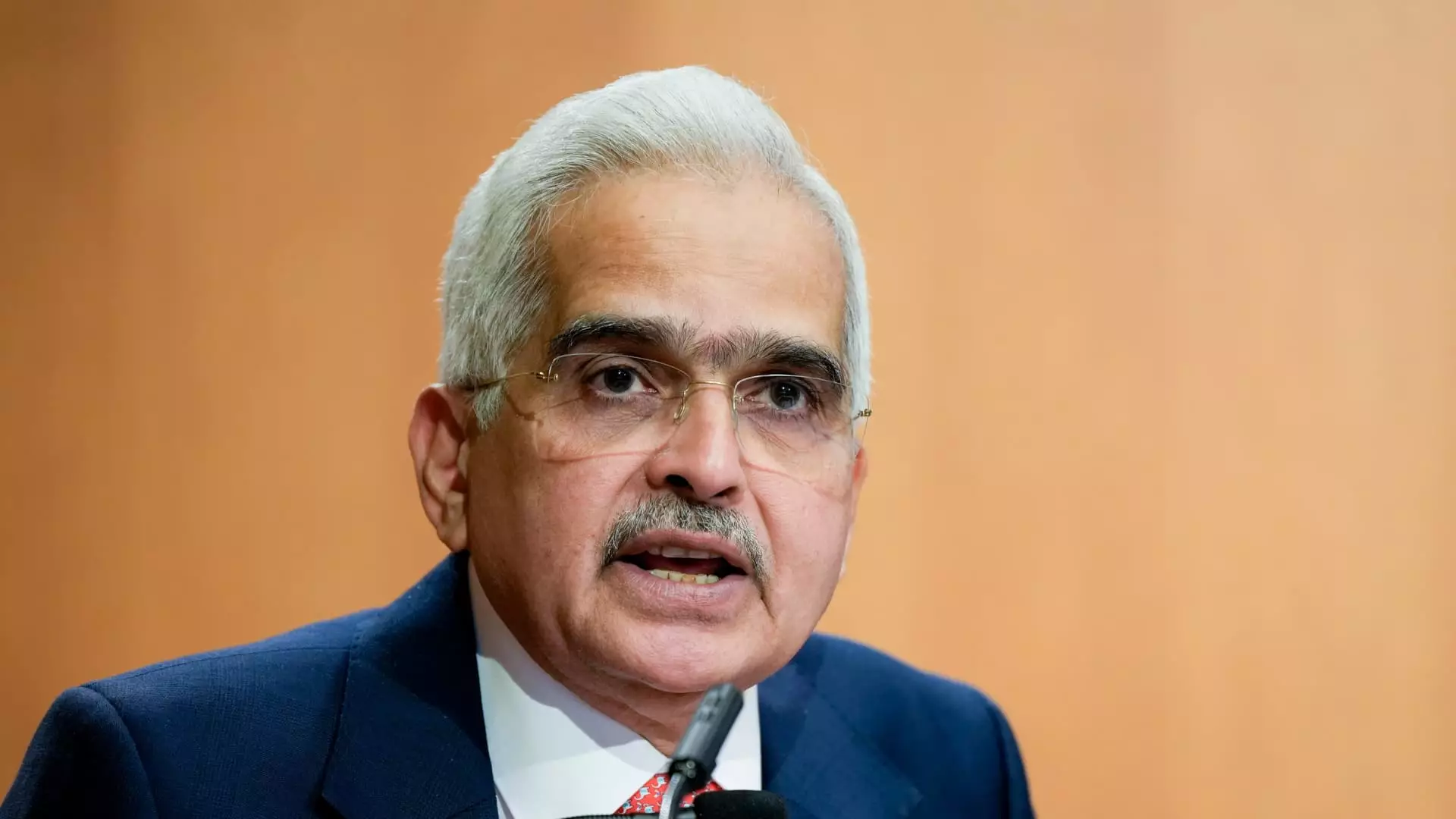

As global economies continue to traverse through tumultuous challenges such as geopolitical conflicts, inflationary pressures, and environmental crises, central banks play a crucial role in steering their nations toward economic stability. Recently, the Governor of the Reserve Bank of India (RBI), Shaktikanta Das, articulated a nuanced perspective on India’s economic standing against the backdrop of worldwide uncertainties. His reflections at the CNBC-TV18 Global Leadership Summit in Mumbai were not only centered on India’s economic resilience but also on the broader implications of global monetary policies.

Das pointed to several paradoxes emerging within the global economic landscape, emphasizing notable contradictions in financial markets. For instance, the ongoing strength of the U.S. dollar persists despite the Federal Reserve’s moves to lower interest rates. This scenario illustrates how interconnected economies react in unexpected ways, often driven by factors beyond policy changes. The U.S. dollar index’s recent spike to its highest levels since the previous November adds additional complexity, exposing vulnerabilities in other markets and reflecting how external factors can influence local economies.

Moreover, the dynamics between government bond yields and the strategies of various central banks underscore the complexity of current monetary interactions. As demonstrated by Das, higher bond yields defy the expectation that rate cuts should generally suppress yields, showcasing how intertwined global and domestic economic factors can complicate traditional monetary pathways. Such reflections call for a more robust analysis of how economies can maintain stability while navigating external volatilities.

Another significant point raised by Das was the contrasting behavior of commodities amidst surprising market trends. Normally, gold and oil prices correlate closely, yet current market conditions have shown remarkable divergence. This inconsistency can be indicative of underlying tensions in the global supply chain and market sentiment. As geopolitical tensions rise, financial markets appear to exhibit resilience, challenging conventional expectations where increased risks typically translate into heightened volatility.

The central bank governor also highlighted the intricate link between rising geopolitical tensions and the stability of financial markets. Remarkably, as conflicts brew around the globe, financial markets have demonstrated a surprising capacity to absorb shocks, which raises questions about the factors influencing market sentiment and the extent to which equities can decouple from geopolitical realities.

Turning the focus to India’s economic outlook, Das expressed optimism about the country’s performance despite the surrounding turbulence. He noted that while inflationary pressures might pose risks, India’s growth trajectory remains robust, suggesting that the nation has successfully weathered prolonged uncertainty. This resilience is not merely a product of chance but reflects sound economic governance and policy frameworks that the RBI has implemented to foster stability and growth.

Nonetheless, the need for fiscal stimulus is echoed in the call for monetary policy adjustments. India’s Union Minister of Commerce, Piyush Goyal, emphasized the importance of reducing interest rates to further propel economic growth. His assertion that India is the fastest-growing economy highlights the strategic advantage the country holds, yet he candidly points out the necessity for additional measures to maximize potential.

As global trade continues to recover from previous disruptions and is projected to be stronger in the coming periods, there remains urgency in tackling the challenges posed by tariffs and import regulations. Collaborative strategies between nations could yield significant benefits, fostering a more integrated and resilient global economy.

Furthermore, the RBI’s recent decision to maintain its key interest rate at 6.5% and shift to a “neutral” policy stances reflects an adaptive approach amidst fluctuating economic conditions. This flexibility is critical, as it positions India to adjust quickly in response to both domestic and international economic signals.

The insights revealed by Shaktikanta Das illustrate the complexities surrounding global economic management in today’s rapidly shifting landscape. As central banks navigate unprecedented challenges, their ability to balance monetary policy, sustain growth, and adapt to new realities will be essential. The interplay of policies, commodities, and geopolitical factors will undoubtedly dictate the future economic narrative not only for India but for the world at large. Resilience will be key, as nations strive to harmonize economic growth with the persistent threats posed by global instability.

Leave a Reply