In the throes of financial turmoil, investors are constantly seeking refuge, and in a recent compelling show of strength, Berkshire Hathaway emerged as a beacon of stability. At a time when President Trump’s aggressive tariff policies set off a chain reaction that led to immense losses across the stock market, Berkshire Hathaway offered a stark contrast. While the S&P 500 suffered a significant decline, plunging 9.1%, Berkshire’s Class B shares only dipped by 6.2%. This performance indicates not just resilience but also the enduring confidence in Warren Buffett’s diversified conglomerate amid a global economic shake-up.

The broader context underscores a critical juncture for investors. The current political climate is fraught with unpredictability; Trump’s decisions have sparked fears of a global trade war, sending shockwaves through stock valuations and investor sentiments. It is during such precarious periods that the allure of a cash-rich conglomerate like Berkshire becomes pronounced. With a staggering cash reserve of $334 billion, Berkshire Hathaway represents not just a stock investment but a fortress for capital preservation.

The Performance Indicator Amid a Downdraft

Interestingly, while many major stocks tumbled, Berkshire was the only one among the top 10 S&P 500 companies that maintained a trajectory above its 200-day moving average. This technical indicator serves as a vital sign of momentum and investor sentiment. Notably, Rich Ross, the head of technical analysis at Evercore ISI, emphasized the uniqueness of Berkshire’s position, stating that while the 200-day average isn’t the sole indicator of success, it remains highly relevant. Such distinctions matter in a landscape where volatility reigns and many investors scramble for clarity.

The ability to buck market trends while remaining tethered to the national economy positions Berkshire Hathaway favorably in the eyes of investors looking for refuge. This relief is not merely an appraisal of financial might but also reflects a strategic pivot in how investors assess risk in light of the current political landscape.

Structural Resilience Amid Policy-Induced Chaos

Buffett’s conglomerate is not just a neutral player; it is fundamentally intertwined with the resilience of the U.S. economy. Unlike many corporations that find themselves vulnerable to the unpredictable whims of Trump-era policies, Berkshire Hathaway has insulated itself from such capriciousness. Ritholtz Wealth Management CEO, Josh Brown, highlighted this aspect by asserting that some companies cannot afford to be shackled to Washington’s political machinations for their survival. Berkshire’s diverse operations—encompassing insurance, manufacturing, retail, and energy—further bolster its fortitude, creating layers of protection against adverse conditions originating from political turbulence.

As investors grapple with inflationary pressures and uncertainties stemming from international trade disputes, having a stable entity like Berkshire Hathaway becomes increasingly comforting. The company’s defensive business structure and its historical penchant for prudent acquisitions present a starkly different narrative from investments that rely heavily on governmental policies or short-term fluctuations in investor sentiment.

Public Perception and Personal Branding

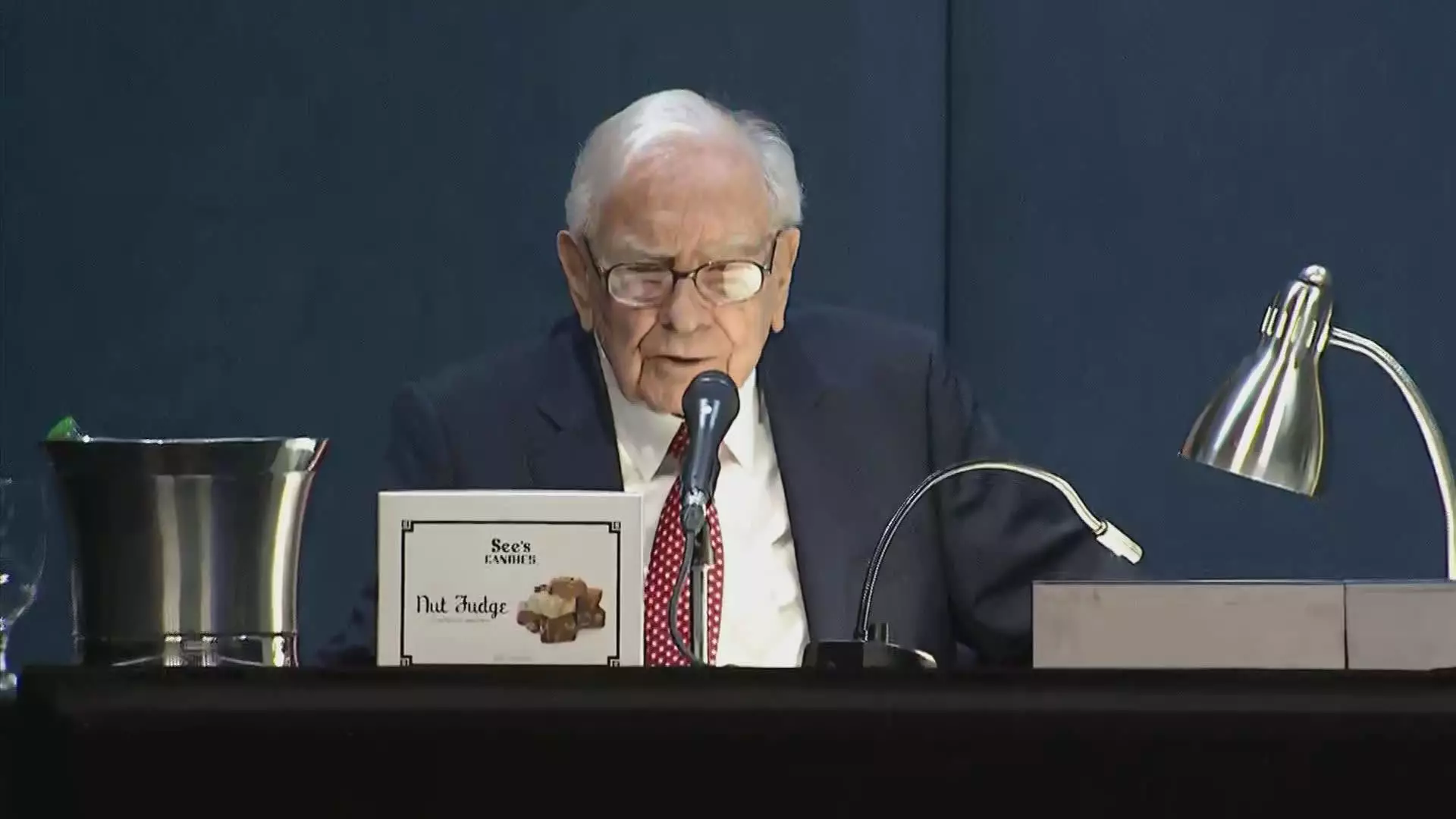

In addition to its robust financial standing, Berkshire Hathaway boasts an unparalleled public image, significantly shaped by Warren Buffett himself. The venerable 94-year-old’s public denials regarding alleged statements made on social media reflect a concrete reputation management strategy. While Trump sparks waves of division and speculation, Buffett remains a unifying figure, focusing on long-term value creation rather than the erratic nature of political discourse. This distinction not only enhances investor confidence but underscores the moral framework against the backdrop of a turbulent market.

In a world increasingly defined by economic uncertainty and political machinations, Berkshire Hathaway stands tall as not just a successful business but as an emblem of hope. It challenges the volatile narratives spawned by turbulent politico-economic realities, offering a more stable and resilient investment identity. In this respect, Berkshire Hathaway and Warren Buffett exemplify the kind of leadership that reassures investors that even in the darkest of times, there are still havens of sanity and stability worth believing in.

Leave a Reply