The recent decision by the Federal Reserve to cut interest rates by a quarter point may seem like a routine adjustment, but the dissent from newly-confirmed Governor Stephen Miran signals much deeper concerns about the direction of monetary policy. Miran’s call for a half-point cut reveals a discordant attitude within the Fed—one that prioritizes aggressive easing over cautious, data-driven decision-making. While some interpret this as a reflection of evolving economic confidence, I view it as a dangerous push toward reckless financial experimentation with devastating consequences for the average American.

The central issue lies in the philosophical undertones of rate cuts: are they truly a remedy for economic instability or a way to mask deeper structural issues? Miran’s stance, which advocates for a far more aggressive reduction than his colleagues, exposes a destabilizing tendency to prioritize quick fixes. This approach risks creating a false sense of security, encouraging reckless borrowing and investment decisions that could ultimately foster bubbles rather than sustainable growth.

Unmasking the Political Underpinnings

The broader context makes it impossible to ignore the political motivations intertwined with this monetary posture. Miran’s appointment, which was conveniently announced amid high-profile conflicts between the Trump administration and the Fed, elevates concerns about the central bank’s independence. Trump’s vocal interest in manipulating rates—calling for reductions of up to three percentage points—underscores a troubling trend of politicizing monetary policy, undermining the Fed’s role as an unbiased guardian of economic stability.

This environment fosters an unsettling environment where rate decisions become tools for short-term political gains rather than long-term fiscal health. Such interference risks inflating asset prices and strewing economic landmines that could explode at the most inopportune moments. The independence of the Federal Reserve, a critical safeguard for balanced policy, is being eroded beneath the weight of political pressure, which ultimately jeopardizes the prospects for a resilient and equitable economy.

The Perils of Excessive Easing in a Fragile Economy

From a center-left perspective, the obsession with aggressive rate cuts raises alarm bells. This approach neglects the inherent risks associated with maintaining an over-relaxed financial environment—risks that disproportionately harm those outside the top economic echelons. Lower interest rates tend to favor corporate insiders, asset owners, and speculators, widening the inequality gap and depriving ordinary households of the stability they need to plan long-term.

At the core, monetary easing is a double-edged sword. While it may stimulate borrowing and consumption temporarily, it can also sow the seeds for inflationary pressures and financial fragility. A too-easy monetary policy can lead to asset bubbles that burst without warning, leaving everyday Americans financially vulnerable. The pursuit of rapid rate cuts, championed by figures like Miran, undermine the subtle balance needed to foster sustainable growth rooted in real productivity rather than speculative excess.

Implications for Future Policy and Public Trust

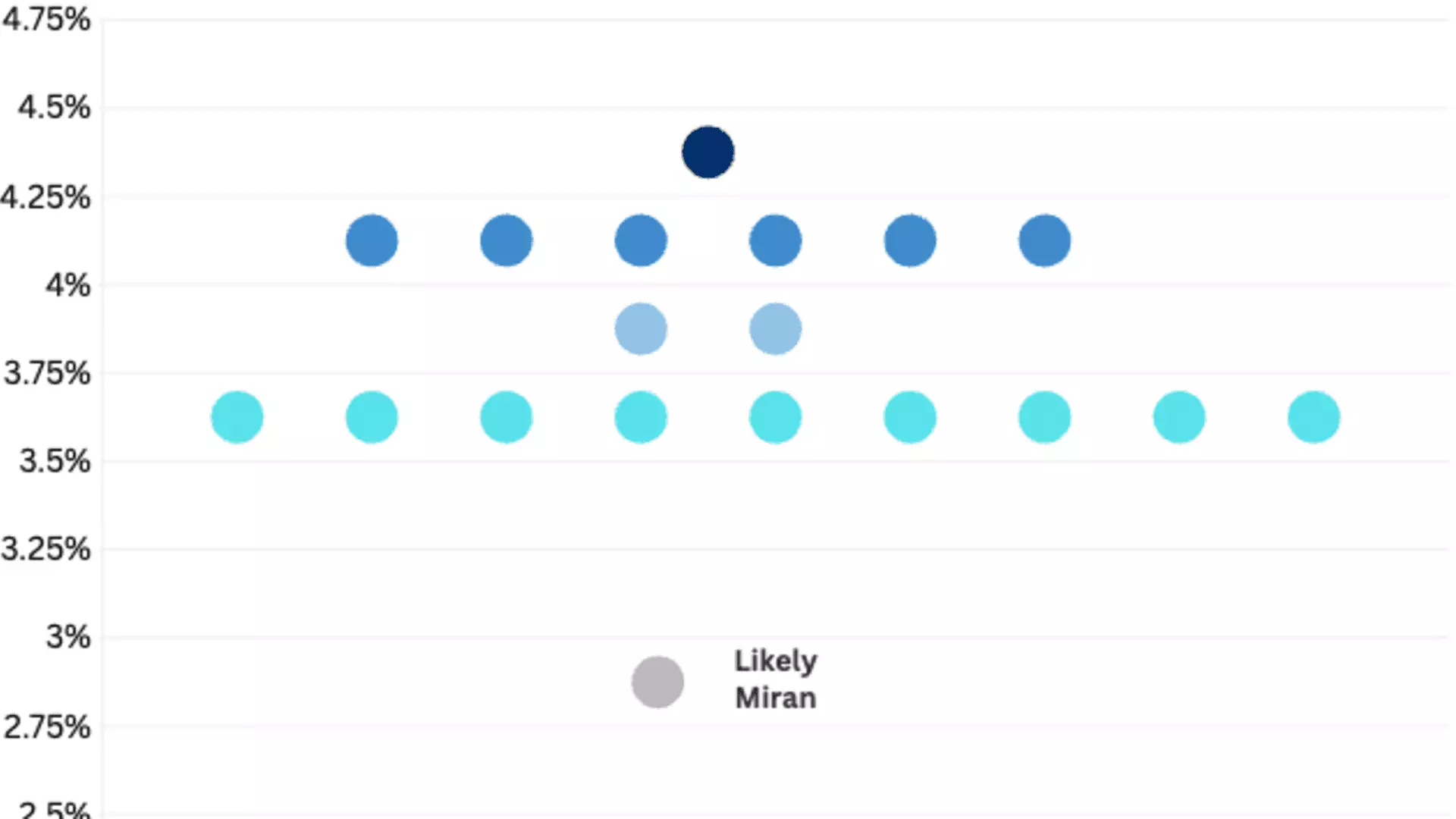

The unsettled debate among Fed policymakers about expected rate pathways—especially with such wide divergence—should serve as a wake-up call. If the public perceives the central bank as merely a pawn of political whims, confidence in its ability to navigate future crises will diminish. This erosion of trust hampers effective policymaking and can trigger panic during downturns, with devastating social consequences.

Knowing that some members believe in more than two rate cuts in 2025, and others see multiple reductions in 2026, reveals a deeply fractured vision of economic stewardship. It underscores the danger of overly politicized decision-making, risking a future where monetary policy becomes more about appeasing political patrons than serving the broader public interest. Any pursuit of aggressive rate cuts must be tempered with humility and a recognition of their long-term dangers. This is not a battle for short-term economic ‘rescue’ but a call for prudence, balance, and a renewed commitment to safeguarding the stability and fairness that underpin our democratic society.

Leave a Reply