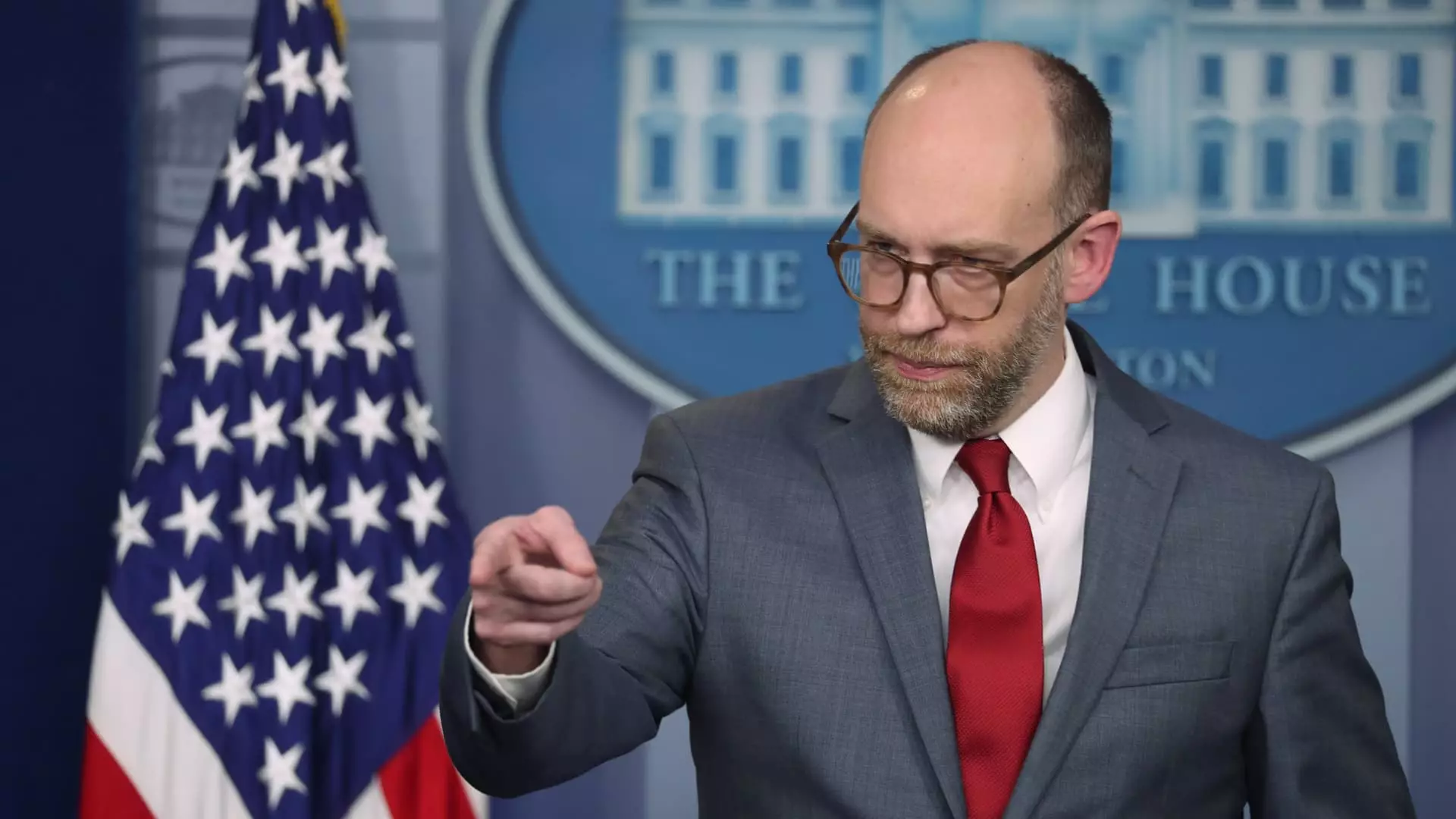

Recent developments within the Consumer Financial Protection Bureau (CFPB) have sparked significant concern and uncertainty surrounding the agency’s future. On a critical note, a memo from CFPB Chief Operating Officer Adam Martinez outlined the directive for employees to work remotely, closing its Washington, D.C., headquarters through at least February 14. This decision follows the original communication from the newly appointed acting director, Russell Vought, which effectively put a halt to the majority of the CFPB’s operations. Such drastic measures have raised eyebrows, especially from within the financial sector that closely monitors regulatory activities.

The cessation of nearly all regulatory activities comes on the heels of a tumultuous week for the CFPB. Under Vought’s initial directives, regulatory supervision of financial firms has been included in the suspension, leaving an operational void that could have far-reaching implications. The CFPB was established to protect consumers in the financial marketplace, but with leadership shifts in place and operational freeze, there are growing fears among stakeholders that the agency’s essential functions may be compromised.

Adding to the intrigue is the involvement of operatives from Elon Musk’s DOGE group, who reportedly gained access to sensitive CFPB data, including employee performance evaluations. This raises serious questions about data security and the integrity of the regulatory framework in place. The implications of this access are concerning for many, especially given Musk’s vocal criticisms of the CFPB, including calls for its dissolution. Such an environment creates an unsettling backdrop against which the CFPB must navigate its immediate future.

Moreover, the announcement made by Vought about halting the flow of funding to the CFPB signifies a troubling shift in the agency’s financial autonomy and governance. His proclamation about turning off the “spigot” that has historically contributed to the CFPB’s operations points to a potential strategy aimed at dismantling its regulatory capacity. This move could critically undermine the CFPB’s ability to perform its functions and provide consumer protections, intensifying scrutiny over the agency’s role and independence.

Vought’s confirmation as the head of the Office of Management and Budget and his involvement in Project 2025—an initiative intended to overhaul federal government structure—introduce further complications for the CFPB. The project aims to reshape various aspects of federal management, but the lack of clear communication and transparency regarding its objectives raises concerns about the future positioning of the CFPB.

The CFPB finds itself at a pivotal juncture, negotiating challenges posed by new leadership, external interests, funding issues, and a shifting regulatory framework. Stakeholders are left in a lurch without clarity on the agency’s long-term viability. As the situation unfolds, it will be crucial for all parties involved—including lawmakers, industry leaders, and consumers—to advocate for transparency and accountability to ensure the CFPB can effectively fulfill its mission. The coming weeks will undoubtedly be critical in determining the agency’s fate and its impact on consumer financial protection.

Leave a Reply