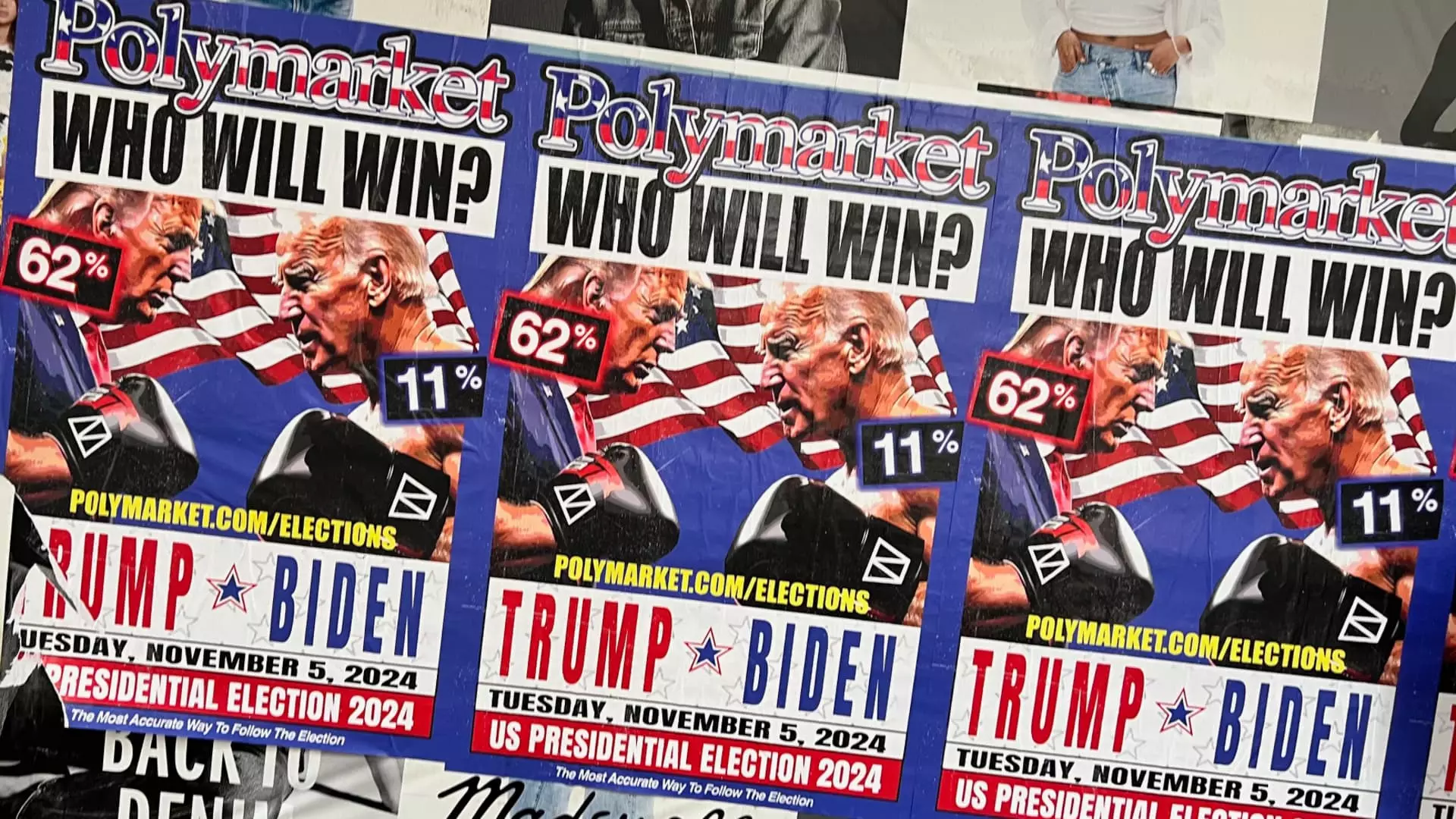

The realm of prediction markets has garnered significant attention, particularly following Polymarket’s recent announcement to reintroduce its betting services to U.S. customers. This comes on the heels of their remarkable ability to accurately forecast the electoral triumph of President-elect Donald Trump. In a candid interview with Andrew Ross Sorkin on CNBC’s “Squawk Box,” Polymarket’s founder and CEO, Shayne Coplan, emphasized the collective efforts that have paved the way for the legalization of political prediction markets in the United States. This movement marks a notable shift in an environment previously constrained by regulatory challenges.

Polymarket, which had previously suspended its operations in the U.S. due to regulatory issues, now finds itself at the forefront of an evolving marketplace. The platform’s abrupt halt in 2022, following a significant penalty imposed by the Commodity Futures Trading Commission (CFTC) for non-compliance with registration requirements, underscored the delicate balance between innovation and regulation. The recent legal developments, including a favorable ruling for Kalshi’s election contracts by the U.S. Appeals Court, suggest a burgeoning tolerance for these market mechanisms within American financial regulations.

The renewed interest in political prediction markets raises questions about their potential impact compared to traditional methods, such as polling. Industry leaders are optimistic. Thomas Peterffy, the founder of Interactive Brokers, pointed out that the political betting landscape could surpass that of equities in the coming years, indicating a significant paradigm shift. This sentiment is echoed by Robinhood’s CEO, Vlad Tenev, who posited that the monetary stakes involved in these markets instill a greater reliability in the outcomes than conventional polling methods.

The advent of these platforms marks a dramatic departure from earlier, more rigid methodologies of political forecasting. With millions of dollars wagering on Trump’s electoral victory, investors are not merely passive observers; their financial stakes drive a level of engagement and accuracy previously unseen. This financial motivation could, theoretically, yield more reliable predictions, as underscored by the enthusiasm exhibited by tech mogul Elon Musk, who has publicly praised Polymarket.

The Impact of Money on Market Predictability

The convergence of technology and finance through platforms like Polymarket represents a fundamental shift in how electoral outcomes are predicted and understood. Coplan’s assertion that markets reflecting financial commitments could serve as a more precise measure of public sentiment draws attention to the intrinsic value of placing money on the line. Notably, on Election Day, prediction markets demonstrated substantial increases in Trump’s favor, and trading volumes skyrocketed to nearly $3.7 billion on Polymarket alone.

What becomes increasingly evident is the dynamic nature of these markets, which respond rapidly to changing political landscapes. Coplan’s observation about the stark contrast between market predictions and traditional media narratives highlights a crucial advantage of prediction markets: their potential to offer real-time insights into public sentiment that are often missed by polling or media interpretations.

With Polymarket poised for an aggressive expansion in the United States, the future of prediction markets seems incredibly promising. The revitalization of this platform not only enhances the credibility of financial stakes in political outcomes but also emphasizes the critical role they can play in shaping public discourse around electoral politics.

This paradigm shift represents a fascinating intersection of gambling, finance, and public sentiment, raising critical questions about the ethics and implications of monetizing political predictions. As the Overton window – the range of acceptable policies – continues to shift, so too will the public’s engagement with political processes. Coplan, at just 26 years of age and the visionary behind Polymarket, stands ready to navigate this evolving landscape.

The reentry of Polymarket into the U.S. market signals more than just the revival of a betting platform; it heralds a transformative phase where markets may serve as pivotal tools for understanding political dynamics. As more individuals and institutions embrace this approach, the implications for policy-making, electoral strategies, and public engagement will be profound, potentially reshaping the way democracy functions in this modern age.

Leave a Reply