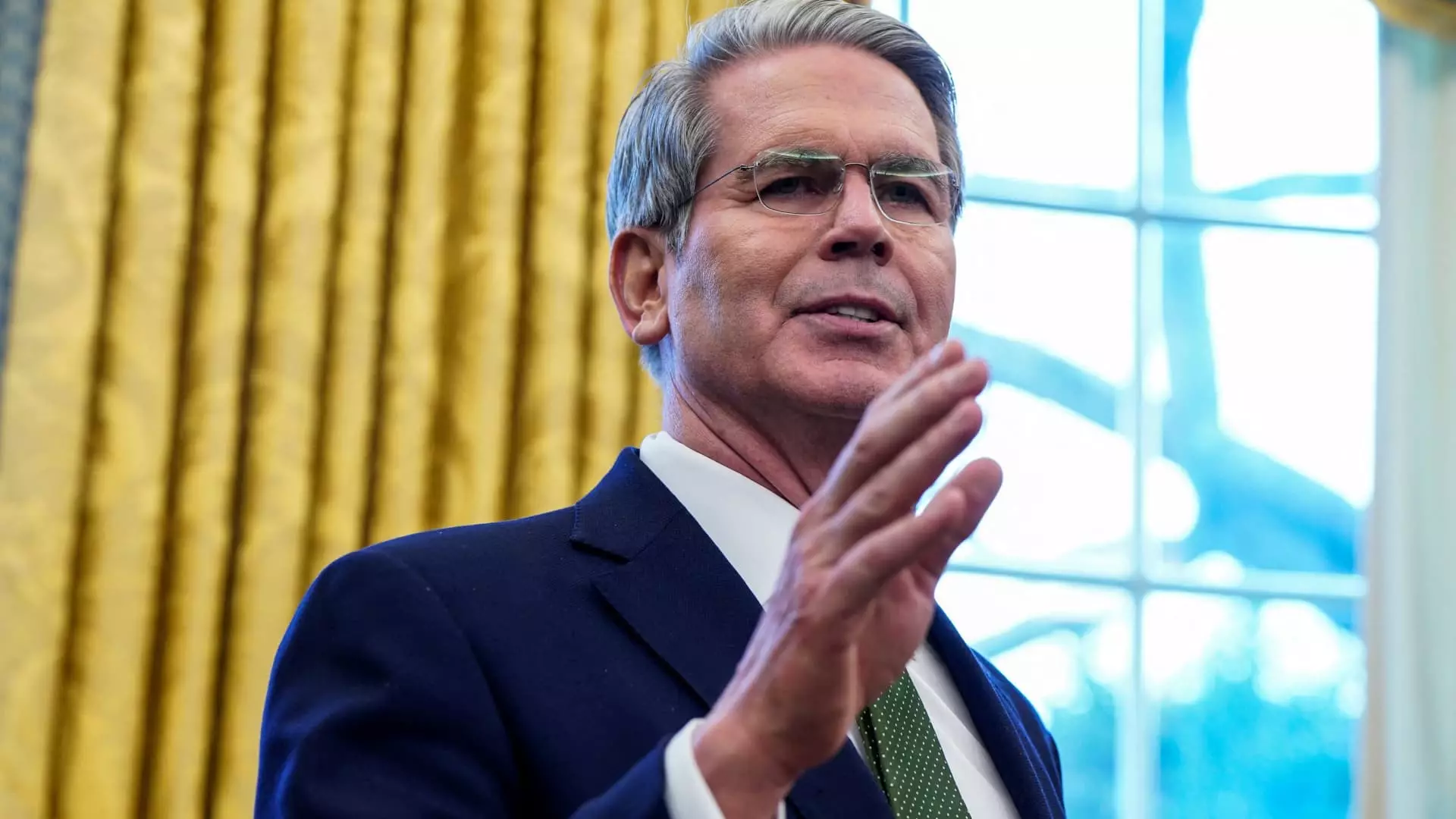

When examining the economic strategy of the Trump administration, particularly regarding interest rates and Treasury yields, it is essential to understand the distinctions between monetary and fiscal policies. Recent statements from Treasury Secretary Scott Bessent illuminate a clear shift in how the administration views these policies, focusing increasingly on Treasury yields rather than solely on the actions of the Federal Reserve.

Historically, the Federal Reserve’s federal funds rate has been the primary tool for influencing economic activity, with implications that ripple across various financial products including loans, mortgages, and credit cards. However, Bessent articulated an evolving approach for Trump’s administration, emphasizing the importance of the 10-year Treasury yield instead. This shift signals a strategic pivot away from traditional reliance on Fed rate cuts towards an agenda driven by fiscal measures aimed at stabilizing and driving down Treasury yields.

This recalibrated focus is vital not only for the administration’s economic agenda but also for maintaining a buoyant market sentiment. In an interview with Fox Business, Bessent remarked, “The president wants lower rates,” thus highlighting the administration’s commitment to fostering conditions that promote lower yields. This approach aligns with conventional economic theory which posits that lower interest rates can stimulate borrowing and spending, beneficial for economic growth.

Recent actions from the Federal Reserve, particularly the rate cuts initiated in September 2024, illustrate the complexities of monetary policy in relation to fiscal strategy. While a cut in the funds rate typically aims to ease borrowing costs across the economy, the actual movement of the 10-year Treasury yield offers a contradictory narrative. Following these cuts, yields on the 10-year Treasury shot up, contradicting the expectations of lower borrowing costs.

This unexpected outcome might be attributed to rising market-based inflation expectations, which can lead to higher yields even in a declining rate environment. Despite these fluctuations, the Bessent’s assertion that the administration’s priority remains on the 10-year yield reveals an underlying belief that if fiscal policies are effectively executed—like deregulating the economy and achieving the goals set by the Tax Cuts and Jobs Act—market forces will subsequently align to maintain favorable interest rates.

Key pillars of Trump’s administration revolve around deregulation, tax reforms, and energy policies, all framed within a narrative that seeks to create a more efficient government and stimulate economic growth. Bessent commented on the administration’s aspirations to create a conducive environment for interest rates to “take care of themselves.” This suggests a confidence that well-structured fiscal policies can yield positive outcomes without direct interference from the monetary authorities.

Further, discussions about making the Tax Cuts and Jobs Act permanent reveal a strategy focused on sustaining economic momentum through fundamental tax reforms. The belief that cutting government spending and reducing the deficit will facilitate a favorable interest rate environment plays into this larger economic philosophy. Here, the administration’s stance intertwines regulatory changes with fiscal prudence to aim for long-term stability.

Analysts like Krishna Guha from Evercore ISI posit that maintaining the 10-year Treasury yield below 5 percent is critical; if breached, it could signal potential economic instability, disrupting equities and adversely affecting housing markets. Currently, the yield’s recent decrease to around 4.45% begs the question: Is the administration’s focus on this benchmark yield sustainable in the long term, especially in the face of external market pressures?

The interplay between fiscal policy and market forces will be a critical gauge of the administration’s success. Trump has indicated a willingness to support the Fed’s decisions, which creates a paradoxical relationship between his push for lower rates and the independent nature of the central bank. This tension may either yield cooperative outcomes that bolster markets or ignite conflict if yield levels do not align with the administration’s expectations.

Ultimately, as the Trump administration navigates the economic landscape, the trajectory of Treasury yields will serve as both a barometer of its policies’ efficacy and a pivotal factor influencing the broader economic environment. The balancing act between fiscal ambition and market realities will be crucial in determining whether these strategies can indeed foster resilience and sustained growth in the American economy.

Leave a Reply