In 2016, the cryptocurrency world experienced a seismic event when the Bitfinex exchange fell victim to a significant hacking incident. This breach resulted in the theft of nearly 120,000 bitcoins, a sum that was valued at approximately $70 million at the time. Fast forward to today, and the value of those coins has ballooned to an astonishing $10.5 billion, largely due to the cryptocurrency’s dramatic appreciation over the years. The man behind this audacious cybercrime, Ilya Lichtenstein, was recently sentenced to five years in prison, thus marking an important chapter in the ongoing saga of digital theft and the illicit financial mechanisms that support it.

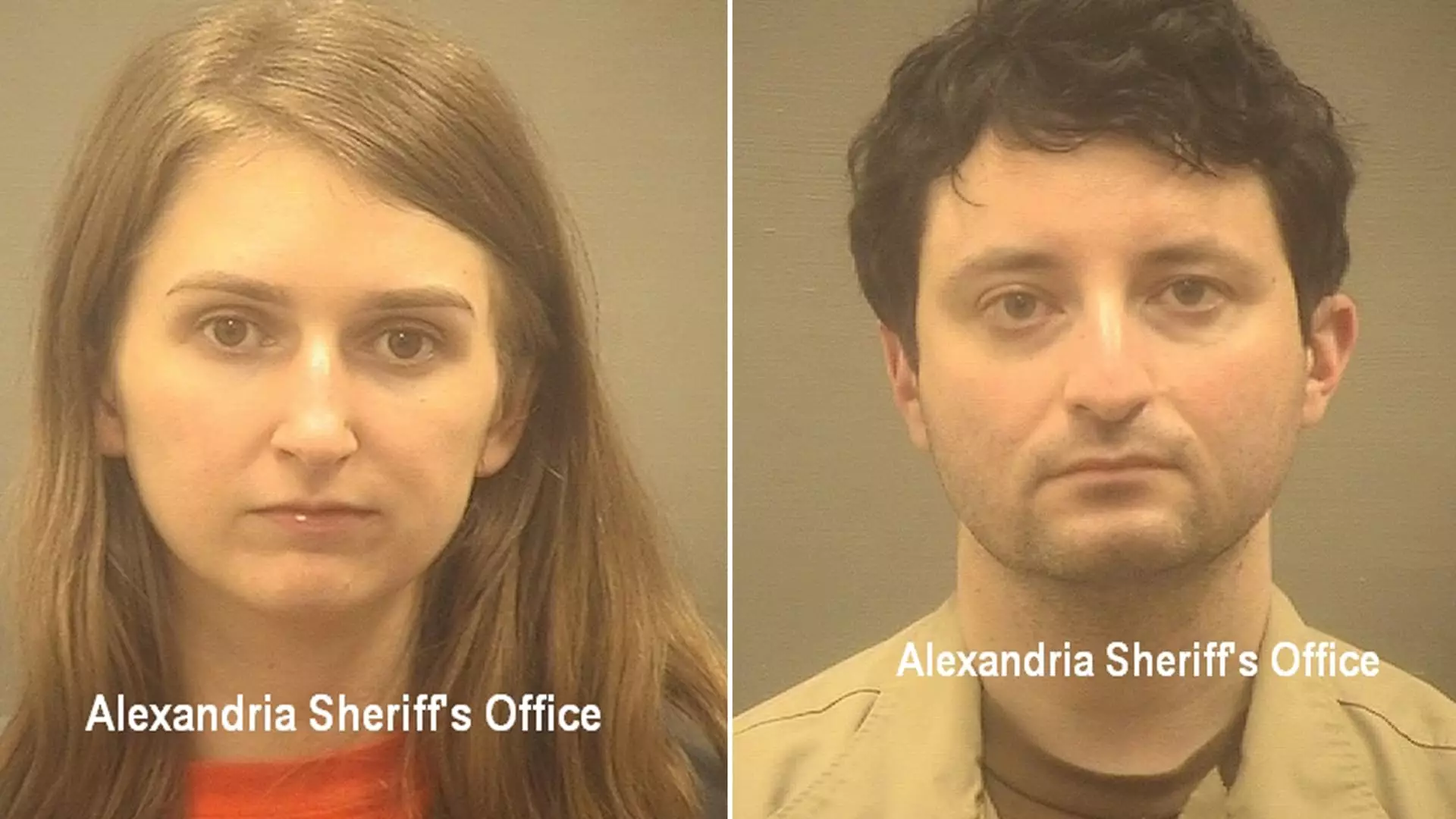

Lichtenstein’s sentencing earlier this week comes after a lengthy legal process that began with his arrest in February 2022 alongside his wife, Heather Rhiannon Morgan. The couple had been charged with an intricate conspiracy to launder the stolen assets from the heist. During an August 2023 court appearance, Lichtenstein publicly acknowledged his role as the hacker, taking responsibility for his actions. His plea for accountability was met with a five-year prison term and an additional three years of supervised release, reflecting the seriousness of his crimes.

In his statement to the court, Lichtenstein expressed remorse and a desire to make amends, a sentiment that, while appreciated, doesn’t erase the magnitude of his actions. Prosecutors highlighted the complexity of the laundering techniques employed, noting that they were “the most complicated money laundering techniques they had seen to date.” This assertion not only underscores Lichtenstein’s technological acumen but also raises questions about the broader implications of such sophisticated criminal activities in the rapidly evolving digital landscape.

Cryptocurrency was initially heralded as a revolutionary technology, promising decentralization and liberation from traditional banking systems. However, incidents like the Bitfinex hack expose the darker side of this digital finance revolution. The ease with which Lichtenstein manipulated digital assets for personal gain serves as a warning about the vulnerabilities inherent in cryptocurrency exchanges. The tragedy is compounded by the fact that legitimate users can suffer greatly from the fallout of such high-profile thefts, leaving them without recourse to recover losses.

Moreover, the apparent anonymity provided by cryptocurrencies leads many to believe that cybercriminals can operate without consequence. However, the eventual downfall of Lichtenstein and Morgan serves as a crucial reminder that law enforcement agencies are making strides in catching up to the methods employed by these digital thieves. The fact that the Justice Department managed to seize over 94,000 bitcoins, valued at more than $3.6 billion at the time of their arrest, indicates a growing competency in navigating the complexities of cryptocurrency transactions.

As authorities continue to reclaim stolen assets, the prospects for restitution draw attention. Prosecutors have noted that they anticipate returning most, if not all, of the seized bitcoins to Bitfinex and possibly other affected parties. This development highlights the importance of regulatory frameworks that seek to address the unique challenges posed by digital currencies. As the cryptocurrency market expands, so too does the need for robust security measures and transparent financial practices.

Despite the cloudy history surrounding digital currencies, the continuous evolution of technology offers hope for a safer environment for future transactions. Enhanced security measures, regulatory interventions, and increased awareness among users can help mitigate the risks associated with online exchanges. As governments and institutions worldwide work to develop better safeguards, the lessons learned from the Bitfinex heist must not be forgotten.

The saga surrounding Ilya Lichtenstein and the Bitfinex hack serves as a sobering reminder of the intricate relationship between technology and morality. While Lichtenstein’s prison sentence may serve to deter similar offenses in the future, the reality remains that the digital landscape will continue to present both opportunities and challenges. For every malicious actor like Lichtenstein, there exists an equally committed force working towards cultivating a safe and sustainable cryptocurrency ecosystem. As this dynamic environment continues to evolve, vigilance, innovation, and responsible practices will be crucial in shaping the future of digital finance.

Leave a Reply