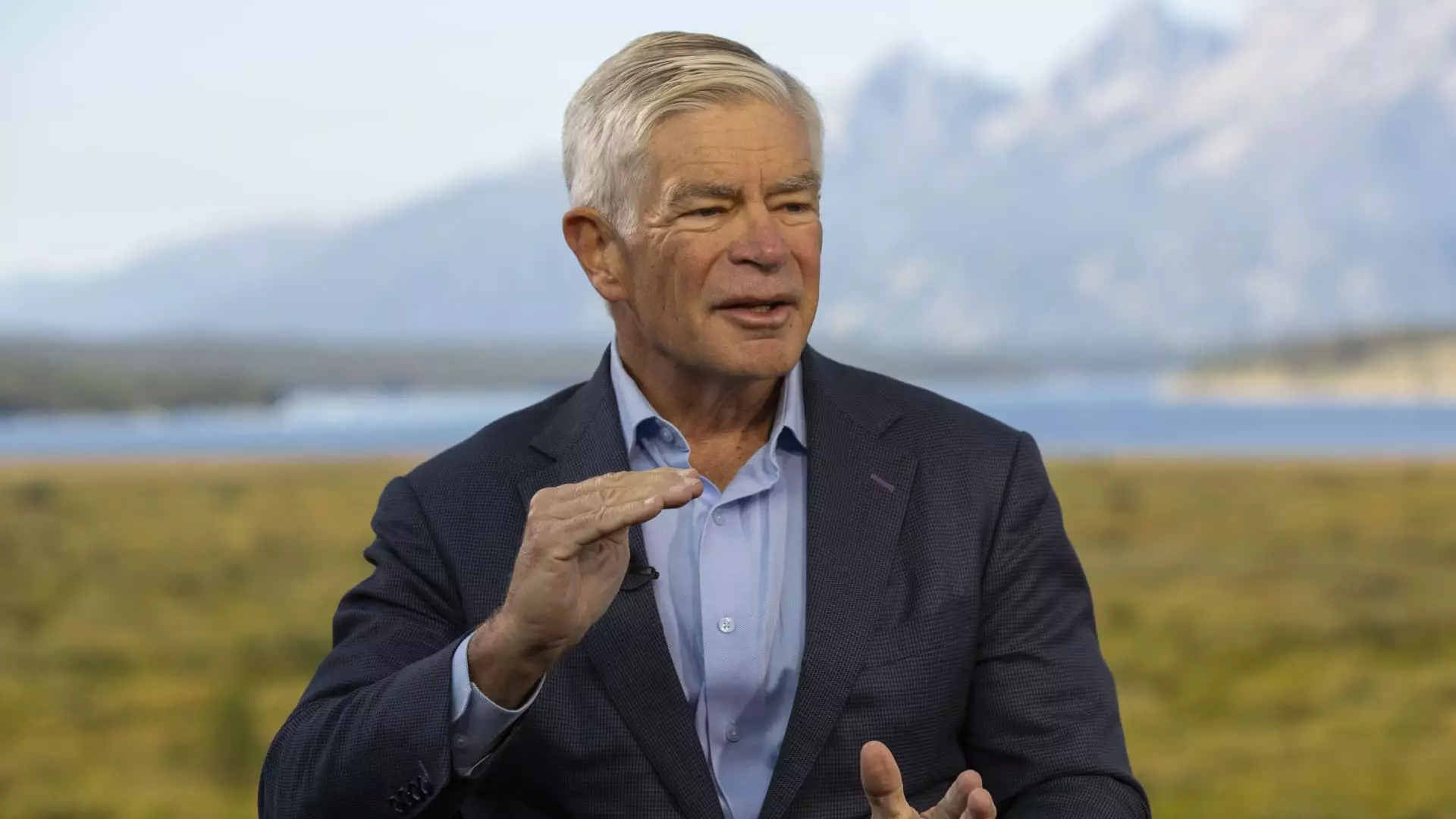

Philadelphia Federal Reserve President Patrick Harker recently expressed a strong endorsement for an interest rate cut in September. Speaking at the Fed’s annual retreat in Jackson Hole, Wyoming, Harker made it clear that monetary policy easing is highly likely at the next meeting of officials. This comes after minutes from the last Fed policy meeting hinted at a potential cut, with officials gaining more confidence in the direction of inflation and showing a proactive approach towards addressing any weaknesses in the labor market.

Harker emphasized the need for the Fed to ease rates “methodically and signal well in advance.” He mentioned that it is crucial to initiate the process of moving rates down in September. While markets have already priced in a 100% probability of a quarter percentage point cut, with a smaller chance of a 50 basis point reduction, Harker remains undecided on the magnitude of the cut. He stated that he requires more data before making a final decision and is open to considering all possibilities.

Policy Independence and Data-Driven Decisions

Despite the upcoming presidential election, Harker stressed the importance of focusing on data-driven decisions independent of political pressures. He highlighted the Fed’s commitment to being objective and responding appropriately based on economic indicators. As a proud technocrat, Harker emphasized the need to analyze the data accurately and adjust policies accordingly. This dedication to data-driven decisions indicates the Fed’s commitment to ensuring economic stability and growth.

Kansas City Fed President Jeffrey Schmid, another nonvoter on the rate-setting Federal Open Market Committee, also shared his perspective on the future of monetary policy. While offering a more nuanced view compared to Harker, Schmid hinted at the possibility of a rate cut in the near future. He pointed out the increasing unemployment rate as a significant factor influencing policy decisions. The shift from a tight labor market to a more relaxed one has implications for inflation and wage growth, prompting a need for a reevaluation of current policies.

Evaluating the Labor Market

Schmid acknowledged the cooling of job indicators and the gradual rise in the unemployment rate as indicators of a changing labor market. While the high-rate environment has supported banks, Schmid believes that there is still room for adjustment in monetary policy. He emphasized the need to closely monitor the evolving labor market dynamics and reassess policies to ensure long-term economic stability. Schmid’s cautious approach underscores the complexity of balancing economic factors when making policy decisions.

Both Philadelphia Federal Reserve President Patrick Harker and Kansas City Fed President Jeffrey Schmid have highlighted the need for a careful evaluation of economic conditions to determine the appropriate course of action regarding interest rates. While Harker leans towards initiating a rate cut soon, Schmid’s more measured stance reflects the complexity of the current economic environment. Ultimately, data-driven decision-making and a commitment to economic stability are paramount in guiding future monetary policy decisions.

Leave a Reply