The global semiconductor industry is experiencing a significant upward trend, catalyzed by a remarkable financial disclosure from Foxconn, a major player in the electronics assembly sector. As Foxconn announced its unprecedented fourth-quarter revenue, the ramifications were felt throughout the semiconductor market, with stocks across various regions witnessing substantial gains. This performance not only highlights the resilient nature of the semiconductor supply chain but also underscores the growing significance of artificial intelligence (AI) technology as a pivotal driver of economic growth.

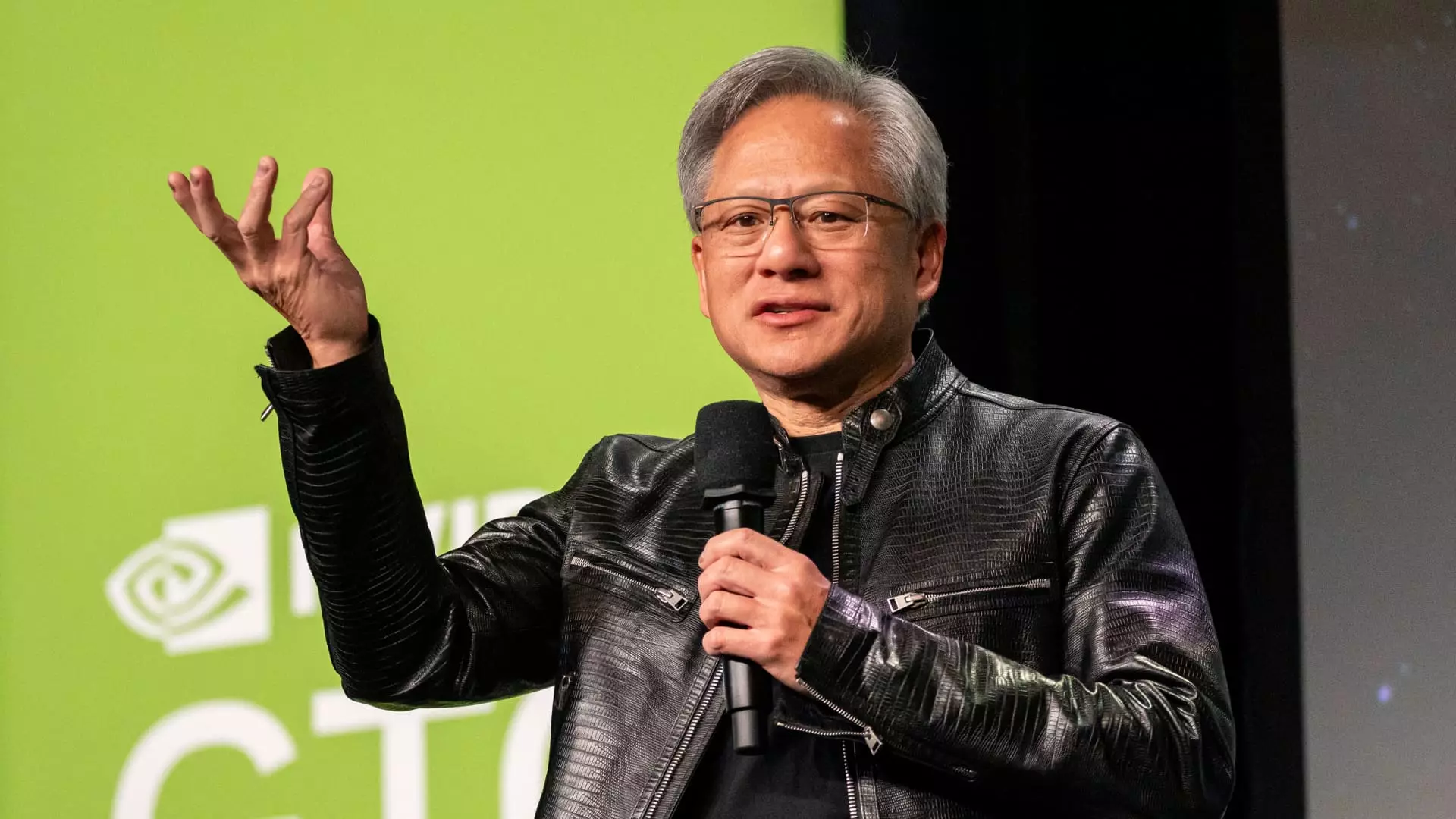

On Sunday, Hon Hai Precision Industry, commonly known as Foxconn, revealed in an official statement that its fourth-quarter revenue reached an astounding 2.1 trillion New Taiwan dollars, equivalent to around $63.9 billion. This figure marks a 15% increase compared to the same quarter in the previous year. The company’s bullish performance was largely attributed to its advancements in cloud and networking products, with particular emphasis on AI servers. These servers, designed in collaboration with chip manufacturers like Nvidia, have become essential components in the fabric of modern computing, catering to the demanding needs of businesses and consumers alike.

It is important to note that while Foxconn’s overall revenue surged, certain segments experienced slight declines. Specifically, computing products and smart consumer electronics—most notably smartphones, including the iPhone—reported decreased sales. This mixed performance illustrates the complexities and fluctuating dynamics within the electronics market, where even established giants face challenges in specific categories.

Market Reactions: Semiconductor Stocks Climb

In the wake of Foxconn’s announcement, semiconductor stocks soared across Asia, Europe, and the United States. Nvidia stood out among U.S. firms, climbing over 3% as investors grew optimistic about future demand, buoyed by Foxconn’s solid numbers. That sentiment was further reinforced by Microsoft’s recently revealed plans to inject $80 billion into data centers capable of supporting AI workloads. This kind of investment from tech behemoths not only benefits Nvidia but also illustrates a broader trend of major companies prioritizing resources for AI capabilities.

AMD also enjoyed favorable market conditions, closing with similar gains alongside Qualcomm and Broadcom. Meanwhile, in Asia, Taiwan Semiconductor Manufacturing Co. (TSMC) achieved record highs, witnessing a nearly 5% rise. As the largest chip manufacturer globally, TSMC’s performance is particularly significant, given its partnerships with high-profile clients like Advanced Micro Devices and Nvidia. The sharp increases in stock prices across the semiconductor landscape, both in the U.S. and Asia, reflect a robust consensus on the importance of this sector in driving technological advancement.

European Semiconductor Gains: Regional Highlights

Europe, too, experienced a surge in semiconductor shares. ASML, a leading global equipment supplier, saw its stock soar by 8.7%. Fellow Dutch semiconductor company ASMI also noted a 6.2% increase. The German semiconductor firm Infineon and France’s STMicroelectronics also enjoyed similar gains, emphasizing that the positive momentum is not restricted to any one geographical area.

This regional diversity in performance illustrates a broader narrative of growth within the semiconductor industry, informed by strategic investments and innovation spurred by the rising demand for AI applications. As companies across regions ramp up their operational capacities to cater to the evolving needs of technology, the semiconductor sector continues to solidify its position as a linchpin in the global economy.

The momentum observed in the semiconductor sector due to Foxconn’s revelation paints a promising picture for the future. As AI technologies continue to permeate various industries, the demand for semiconductors will likely sustain its upward trajectory. Continued investments from major tech firms into infrastructure that supports AI functionalities will further stimulate growth and innovation within this vital industry.

Foxconn’s record earnings provide not only a glimpse of its own success but also reflect a broader trend of investment and optimism in the semiconductor industry. As companies navigate challenges and opportunities alike, the integral role of semiconductors in advancing technology solutions across different markets cannot be overstated. The sector’s growth narrative appears set to continue, driven by an unyielding demand for cutting-edge technology.

Leave a Reply