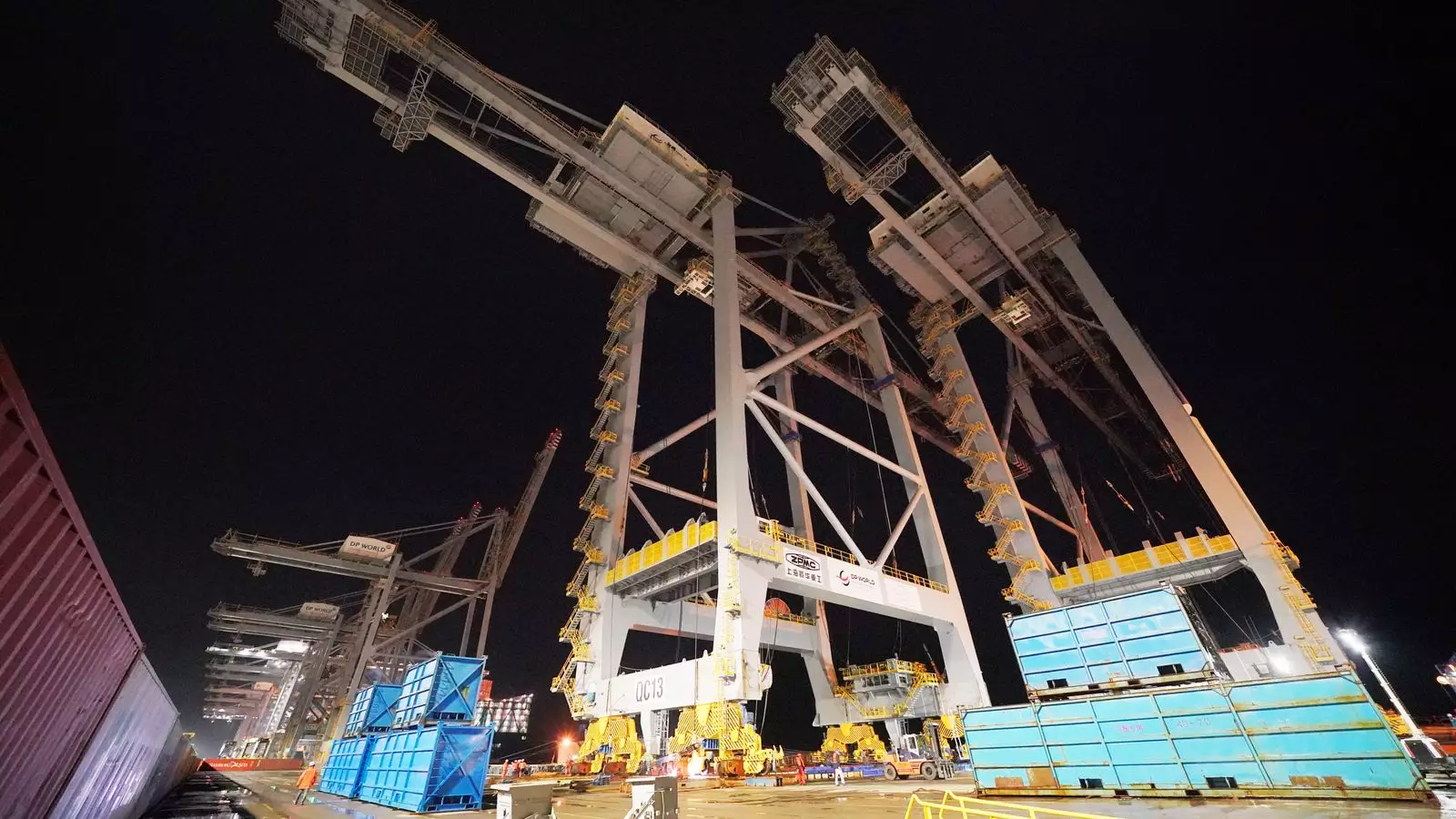

In the fast-paced world of global investments, political relations and public sentiment often tread a thin line. The recent involvement of the UK government with Dubai-based DP World exemplifies this dynamic, showcasing how a singular event—a negative comment from an official—can jeopardize substantial financial commitments. This instance reveals an underlying truth: investment decisions, especially ones as significant as the £1 billion pledge to develop the London Gateway port, are often contingent not only on economic feasibility but also on political climates and public relations.

Rather than merely being passive recipients of investment, governments continuously engage in active negotiations and discussions. Business and Trade Secretary Jonathan Reynolds recently indicated that the government had to “have a conversation” to keep the investment deal on track, underlining the need for diplomatic dialogue. This necessity for conversation serves as a reminder that unforeseen political comments can lead to turbulence in negotiations, forcing leaders to backtrack or recalibrate their strategies.

Central to this incident is the controversial track record of P&O Ferries, a subsidiary of DP World. The company made headlines in March 2022 after it took the drastic step of laying off 800 British seafarers, replacing them with cheaper foreign workers under the guise of financial sustainability. Transport Secretary Louise Haigh did not mince her words, labeling the company as a “rogue operator” and encouraging a consumer boycott. Such strong rhetoric from a government official not only invites public backlash but also places investors in a precarious position where their corporate reputation is called into question.

The term “rogue operator” carries significant weight, suggesting unreliability and unpredictability—traits no investor wishes to associate with their financial ventures. Therefore, Haigh’s remarks inevitably threw the potential £1 billion investment into a spotlight of scrutiny, leading to urgent discussions behind closed doors to salvage what could have been a transformative economic deal for the UK.

Further complicating the landscape was the UK’s upcoming International Investment Summit, which aims to draw attention from leading industry figures and to stimulate massive investments. Scheduled just before the impending 30 October budget announcement raised questions about the appropriateness and timing of such an event. Critics point out that Labour’s initial proposal to hold similar discussions within the first 100 days of government forced the current administration’s hand, potentially reducing the impact of these discussions amid an election year.

The government envisaged significant participation from “up to 300 industry leaders,” framing the summit as a crucial platform for catalyzing investments in the UK economy. However, transparency regarding attendee selection and the overall goals of the summit seems elusive, as demonstrated by Reynolds’ evasive answers regarding the absence of high-profile investors like Elon Musk. While he sidesteps direct questions, his comments hint at a broader narrative: not every potential investor will resonate with the government’s vision or political inclinations.

Moving forward, attracting foreign investment will require the UK government to maintain openness in its dealings while fostering an environment of stability and trust. The situation with DP World serves as a bellwether for other potential investors who may look to the UK for opportunities. As economic landscapes shift, the balance between political discourse and investment allure will become increasingly critical.

Ultimately, the interaction surrounding the London Gateway investment reflects on larger themes in international business. Stakeholders must be cognizant that investment is not merely about capital exchange; it encompasses negotiations, corporate reputation, and political relationships. As the UK government prepares for its International Investment Summit, it must strike a delicate balance between ensuring investor confidence and actively engaging in a responsible and constructive political dialogue. In doing so, it can hope to lay a foundation for a more secure and prosperous economic future.

Leave a Reply