Recent developments in the stock market have shown that investors are keen on tech stocks, especially following the Federal Reserve’s decision to cut its benchmark interest rate for the first time since 2020. This reduction has sparked notable enthusiasm in the market, particularly within the technology sector, prompting an investment spree that many analysts believe could reshape market dynamics in the coming months. Tech giants such as Tesla and Nvidia led the charge, showcasing impressive gains that have reverberated throughout the tech-heavy Nasdaq index, which registered a commendable 2.5% increase on a recent Thursday.

Lower interest rates typically create a conducive environment for technology stocks. By diminishing borrowing costs, these rates make riskier investments more appealing. This particular decrease in rates, coupled with the Federal Open Market Committee’s indication of potential further cuts, has rejuvenated investor sentiment. With further reductions projected, the market anticipates that tech stocks could continue to receive a significant boost, encouraging more investors to allocate funds to this sector.

Tesla, a stalwart in the electric vehicle industry, marked a substantial rise of 7.4%, showcasing resilience and potential amidst macroeconomic challenges. Despite being relatively flat this year, its recent surge indicates a recovery as it moves 72% above its April lows. Investors seem to be re-evaluating Tesla’s potential in an evolving market, where concerns about sustainability and innovation converge.

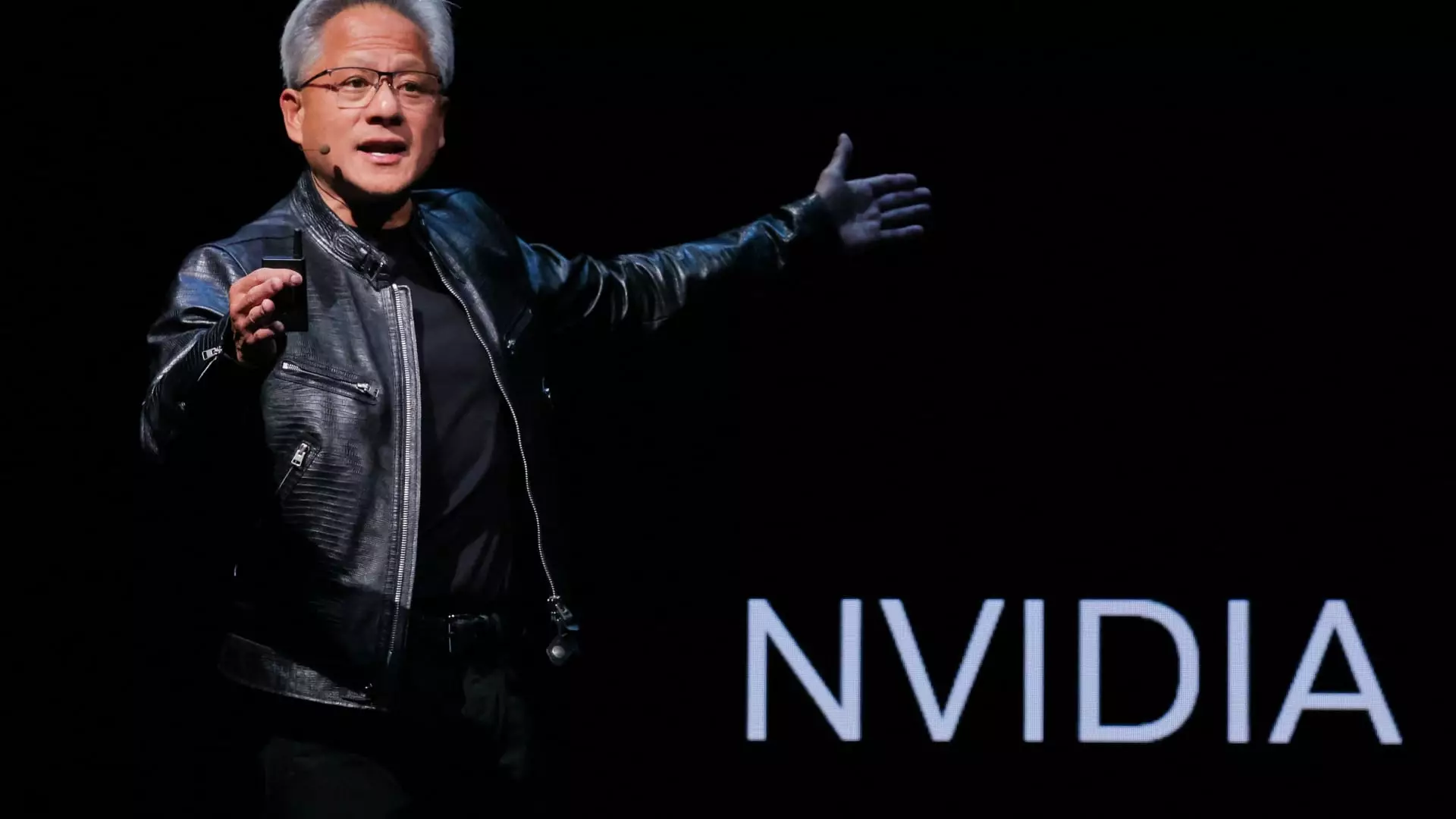

Nvidia, on the other hand, continues to ride the wave of the AI revolution. The chipmaker’s stock appreciated by 4% on the same day, further cementing its status as a key player in the tech landscape. With a Year-to-Date increase of around 138%, Nvidia has captured investor attention, particularly given its pivotal role in powering AI applications such as OpenAI’s ChatGPT. This dependency on a handful of high-profile clients, including tech behemoths like Microsoft and Google, introduces an element of risk; however, the prevailing low-interest rate environment could stimulate demand for Nvidia’s products.

The Competitive Landscape in AI

On the flip side, although Nvidia holds a commanding position in the AI sector, other competitors, such as Advanced Micro Devices (AMD) and Broadcom, are also making waves. AMD, fresh off a 5.7% rise, aims to carve a slice of the AI market, albeit it faces skepticism from analysts who question its speed and viability in this fiercely competitive landscape. AMD’s CEO, Lisa Su, recently emphasized the long-term nature of AI technology, encouraging patience among investors who might be concerned about short-term gains and losses. Su articulated the belief that AI is fundamentally transformative, poised to influence numerous sectors, including education and healthcare.

While it’s easy for investors to chase immediate returns, the reality is that technology trends often materialize over extended periods. This sentiment aligns with the broader market narrative suggesting that investors would be wise to adopt a strategic long-term approach rather than seeking quick wins.

As the Nasdaq index continues to flirt with levels last seen in mid-July, the market is witnessing a paradigm shift towards technology stocks as the backbone of potential recovery and growth. This uptick isn’t just isolated to a few key players. Major names, including Apple and Meta, have also recorded significant gains, each rising nearly 4% during this latest surge. Their participation indicates a broader tech rally that reflects investor confidence in the sector’s resilience.

The interplay between macroeconomic decisions, like interest rate adjustments, and sector-specific performance will be integral in shaping investor strategies moving forward. As economic indicators continue to shift, technology stocks remain at the forefront of market dialogue, and their long-term trajectory could well dictate the overall health of the U.S. stock market.

While the recent tech stock rallies are promising and indicative of investor optimism, the landscape remains complex. Companies must navigate competitive challenges, evolving consumer demands, and macroeconomic variables. However, for now, the horizon looks bright for tech investors.

Leave a Reply