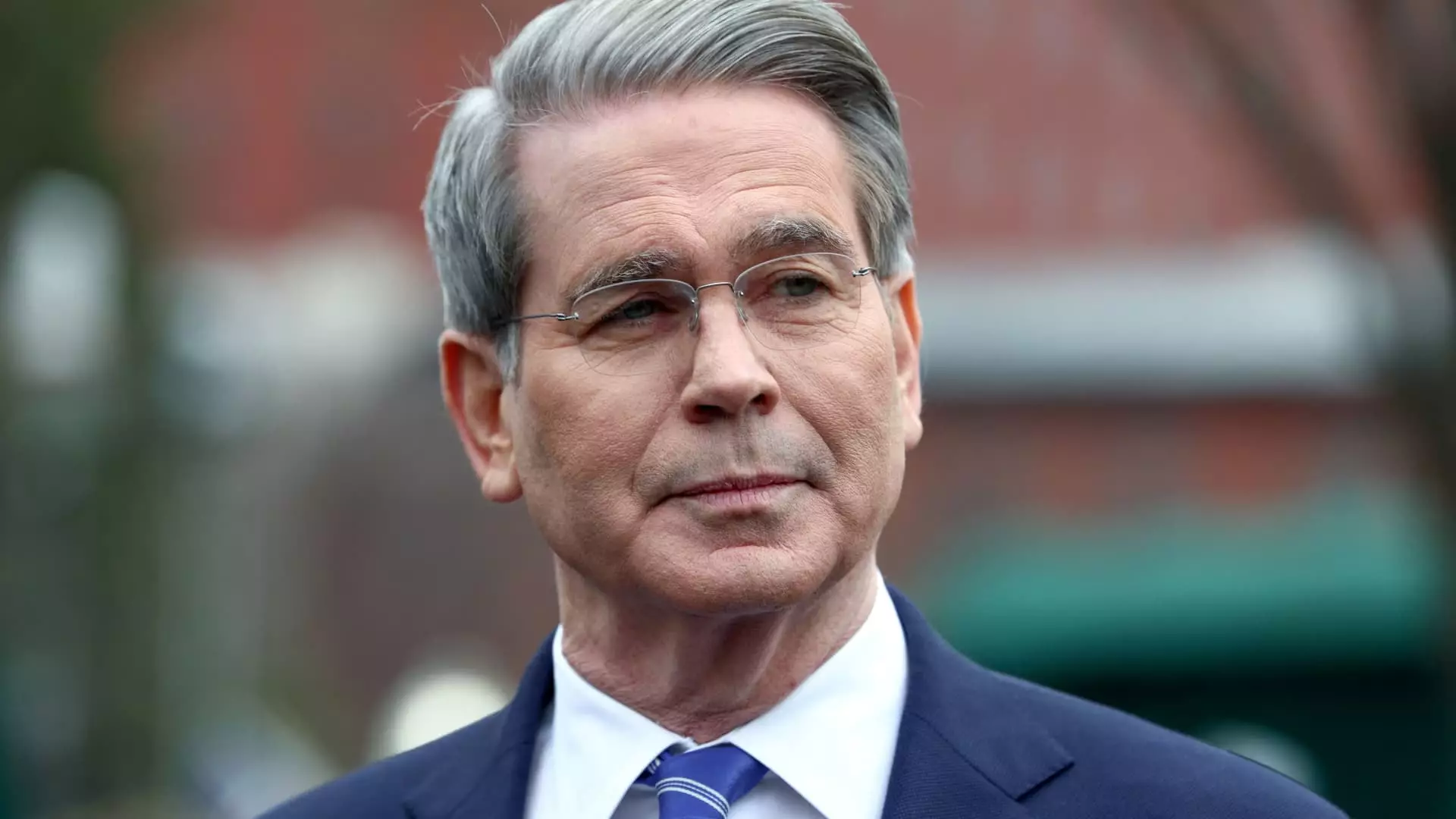

In light of recent remarks made by Treasury Secretary Scott Bessent, one must question the validity of the rosy outlook provided by the current administration regarding America’s economic stability. During a Sunday interview on NBC News’ “Meet the Press,” Bessent labeled concerns about a looming recession and the vulnerability of retirement savings as a “false narrative.” His unwavering confidence in the long-term economic fundamentals being put in place under President Trump overlooks the pressing anxieties faced by millions of Americans, particularly those nearing retirement age. This disconnect between the administration’s claims and the reality experienced by everyday citizens raises alarm bells about the dangers of an overly optimistic façade.

Bessent’s comments exemplify a trend in politics where officials may conveniently ignore the economic plight of ordinary Americans. His assertion that individuals who have diligently saved for their future should not be concerned about market fluctuations sounds insidiously dismissive. Many Americans are not living in a vacuum, insulated from the immediate impacts of the stock market; rather, they are grappling with the uncertainty of their retirement funds taking a nosedive in response to market volatility provoked by tariff implementations.

The Flawed Narrative of Long-Term Stability

While Bessent and the administration maintain that stock market investments are fundamentally long-term and should not be evaluated by day-to-day changes, this perspective ignores a significant truth: many Americans do not have the luxury to take such a long view. The historical disconnection between stock market performance and the day-to-day lives of average citizens is stark. The tragedy lies in the fact that, while top officials speak of prosperity and investment on a macro scale, on the micro scale, people are staring down their financial fears; fears rooted not in paranoia but in tangible declines in savings.

The notion that “most Americans don’t have everything in the market” might soothe some fears but fails to resonate with those just shy of retirement who may have seen their hard-won savings diminished in value. Such remarks feel patronizing – as if the administration is attempting to pacify Americans instead of addressing their very real concerns. Just because investments can yield positive returns over decades does not allay the fear of a dwindling nest egg now, when many are preparing to retire and drawing from those perceived long-term gains.

Price of Tariffs: A Misguided Strategy

Bessent’s comfortable dismissals are particularly troubling in the context of the recent stock market decline following President Trump’s controversial tariff proposal. The suggestion that this downturn could be ignored as a “false narrative” that the market will stabilize overlooks essential economic principles. Markets respond to uncertainty and skepticism, and imposing tariffs is one of the most volatile strategies a government can deploy. Rather than bringing stability as suggested, tariffs often create more uncertainty in trade relations and can become detrimental to both domestic consumers and business owners. This chain reaction beckons a painful adjustment process – one where ordinary Americans bear the brunt of economic miscalculations.

Despite Bessent’s rhetoric that we must endure potential rough patches momentarily for the sake of long-term gain, the reality is that many families cannot afford this approach. The economic adjustments of the past have seen the most vulnerable populations endure the harshest consequences; it is, after all, easy for policymakers to advocate for change while they remain insulated from its implications.

Bubble of Disconnect Between Policy and Reality

The prevailing narrative from administration officials regarding trade practices, inflation, and investment risks flaunts a dangerous level of detachment from the difficulties being experienced by average citizens. Bessent claims, “Our trading partners have taken advantage of us,” painting the situation as a straightforward wrong that needs correction without providing a deeper analysis of how policy decisions will needlessly exacerbate suffering on the home front.

Patience may be a virtue in long-term finance, yet the thousands of Americans who rely on their hard-earned savings for day-to-day living find themselves ensnared in uncertainty, with their financial futures implicitly ignored. Alarmingly, policies crafted in the interest of macroeconomic stability often overlook the inherent fragility of the lives they profoundly impact. By embracing an overly optimistic view cloaked in economic theory, there lies a risk of neglecting the very real realities that millions find themselves grappling with daily.

Leave a Reply