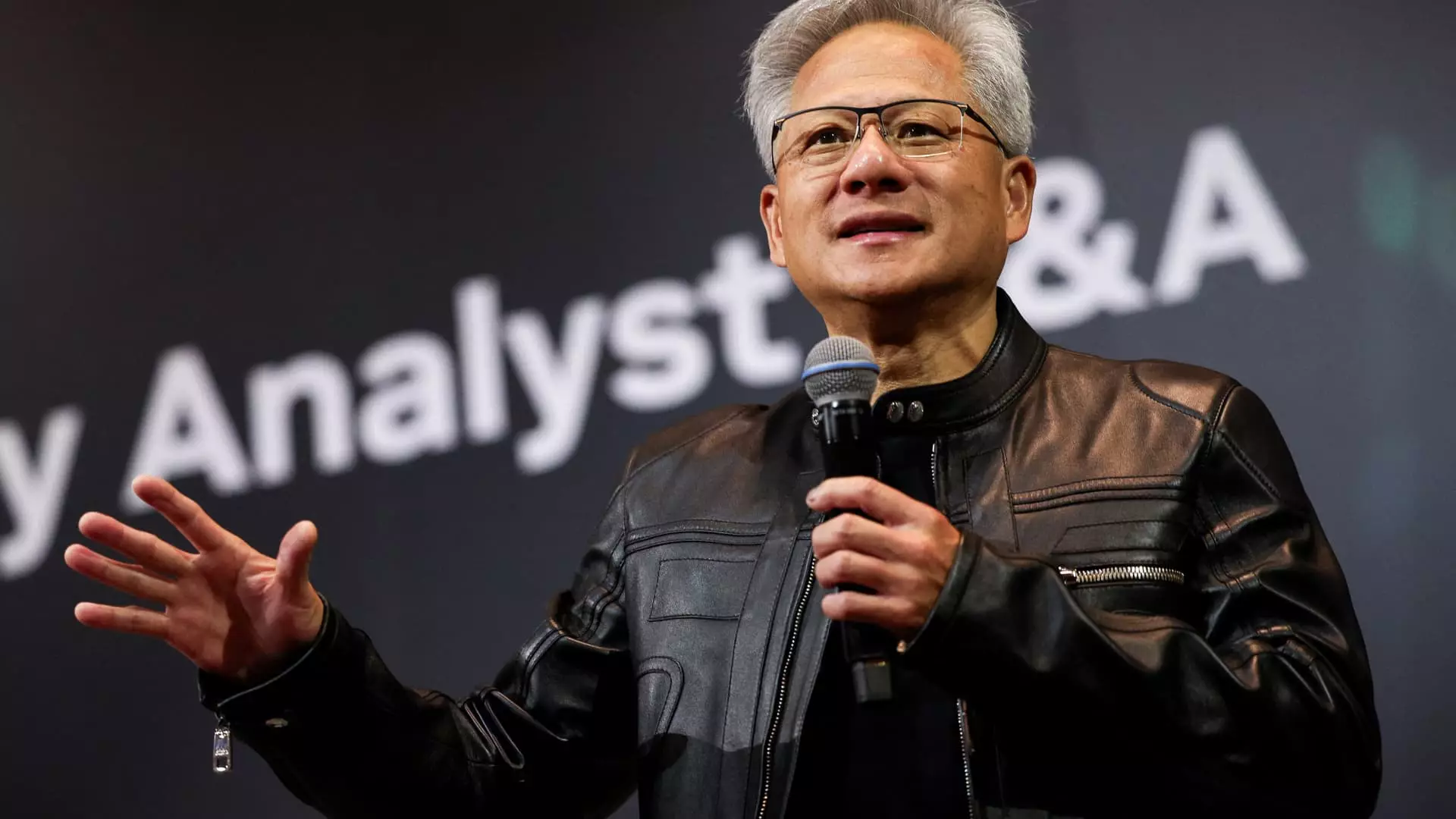

In the wake of recent statements from Nvidia’s CEO Jensen Huang, it becomes increasingly evident that the narrative of global technological collaboration is cloaked in a layer of nationalistic ambition and corporate self-interest. Huang’s enthusiastic praise for Taiwan Semiconductor Manufacturing Company (TSMC) highlights a concerning pattern: reliance on a single, dominant player in the semiconductor industry can obscure potential vulnerabilities. While it may seem strategic to advocate for a major company like TSMC, such unwavering loyalty exposes the broader ecosystem to significant risks, including geopolitical instability, supply chain fragility, and economic dependencies.

The implicit message—”anyone who invests in TSMC is wise”—serves not only as a corporate endorsement but also as a subtle reinforcement of the shifting power dynamics in global high-tech manufacturing. However, this perspective underestimates the danger of over-reliance on Taiwan’s chip manufacturing capacity, a region vulnerable to political strife and external pressures. A myopic focus on TSMC’s excellence ignores the need to diversify sources and develop resilient supply chains, especially when national interests are intertwined with corporate ambitions. This kind of favoritism risks creating monopolistic conditions that stifle competition, innovation, and risk management, turning what appears to be strategic airdrops of praise into a gamble with American and global technological sovereignty.

The Myth of U.S. Sovereignty in Semiconductor Leadership

The Biden administration’s push through the CHIPS Act signals a desire to recapture technological dominance within the U.S. — but at what cost? Investing billions in domestic manufacturing and encouraging companies like TSMC to expand into the U.S. might bolster national security claims and economic independence. Yet, these measures could backfire by fostering a dependence on imported foreign technology, which runs counter to the very sovereignty they aim to enhance.

U.S. officials contemplating equity stakes in TSMC and other firms fail to recognize the inherent contradictions. On the one hand, they declare a strategic desire for autonomy; on the other, they nurture an ecosystem increasingly intertwined with Asia’s economic powerhouses. Highlighting TSMC’s expansion in Arizona and the government’s interest in acquiring shares risks turning into a form of economic coercion that ultimately suppresses the competitive landscape. It’s a dangerous dance that overestimates the capacity of government intervention while undervaluing the importance of fostering a truly independent, innovation-driven domestic industry.

The Central Role of Taiwan and the Power Dynamics at Play

Huang’s assertion that anyone investing in TSMC would be “very smart” underscores a troubling reality: the centralization of global chip manufacturing in Taiwan. This concentration creates an Achilles’ heel for the entire digital economy. As tensions between China and Taiwan simmer, the risk to global supply chains becomes not just a hypothetical concern but a tangible threat to economic stability and technological progress.

Turkey’s and South Korea’s investments in U.S.-based chip manufacturing are notable, but they lack the same strategic weight—mainly because of TSMC’s unmatched capacity and influence. If geopolitical events destabilize Taiwan, the consequences would ripple worldwide, crippling industries that rely on semiconductors for everything from automobiles to AI systems. Relying so heavily on Taiwan makes the U.S. and global markets vulnerable to black swan events beyond their control, revealing a naive faith in geopolitical stability and the narrative that corporate praise can substitute for strategic diversification.

The Risks of Glorifying a Monopoly in Semiconductor Manufacturing

The portrayal of TSMC as a paragon of industry greatness glosses over a more complicated reality: monopoly power breeds complacency, stagnation, and undue influence. When an industry is concentrated in one region and dominated by a few key players, innovation is at risk of stagnation, and prices may become artificially inflated. Furthermore, such dominance potentially enables unfair geopolitical leverage, as TSMC’s strategic importance grants it unparalleled bargaining power.

Nvidia’s reliance on TSMC’s production capacity exemplifies a broader industry trend that favors consolidation over resilience. This is particularly troubling considering the rise of AI, where supply chains need to be dynamic and adaptable. Overhyped praise of TSMC’s leadership ignores the nuances of technological innovation—such as the benefits of fostering multiple manufacturing hubs and encouraging smaller, agile competitors that can challenge the monopoly and drive technological progress.

The Dangerous Trend of Politicizing Corporate Alliances

Huang’s comments echo a broader trend where corporate statements are becoming subtly political, blurring the lines between commerce and geopolitics. The push for government investments, equity stakes, and preferential treatment transforms what should be purely market-driven decisions into geopolitical tools. This politicization endangers free-market principles and risks turning industry into a battleground for national interests, where corporate loyalty is often dictated more by government fiat than by innovation or competitiveness.

By elevating TSMC’s importance and urging investment, the narrative perpetuates the myth that national security can be secured through strategic partnerships and state-backed investments. Yet this approach neglects the underlying problem: such dependencies create systemic vulnerabilities. If the industry becomes too politically entangled, it can distort market signals, stifle competition, and ultimately damage the very technological leadership it seeks to protect.

This analysis reveals the complex web of false security woven around the perceived dominance of TSMC and related firms. We must question whether blind faith in corporate pyramids and national alliances are sustainable strategies for long-term technological sovereignty. The path forward should be rooted in fostering genuine innovation, diversified manufacturing, and balanced geopolitical engagement, rather than superficial praise and strategic betting on a single industry empire.

Leave a Reply