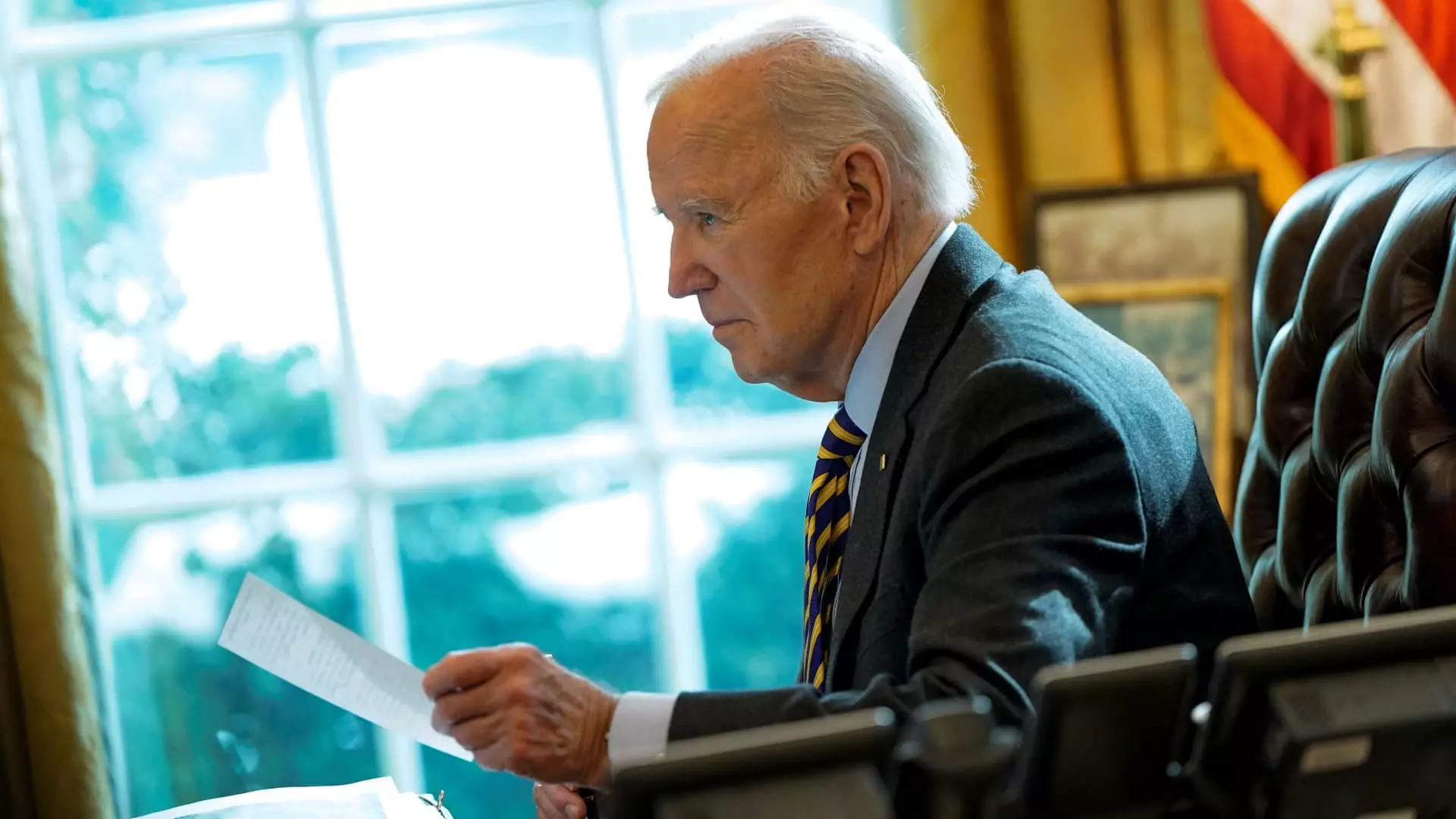

In a significant move within the steel industry, the Biden administration has recently announced a delay in the mandated cessation of Nippon Steel’s $14.9 billion acquisition bid for U.S. Steel, extending the deadline until June 18, 2025. This postponement offers a glimmer of hope to both companies, who are determined to revive this politically sensitive transaction. The initial blockage, enacted by President Biden earlier in the year on national security grounds, sparked heated discussions regarding foreign investment in critical American industries.

Biden’s decision to block the acquisition illustrates the administration’s heightened focus on national security considerations, particularly concerning foreign ownership of significant American assets. The Committee on Foreign Investment in the United States (CFIUS) concluded that allowing Nippon Steel, a firm closely tied to Japanese governmental interests, to acquire U.S. Steel could have adverse implications for the nation’s industrial base—a scenario that could raise alarms in an increasingly competitive global landscape.

Moreover, Treasury Secretary Janet Yellen reaffirmed the thoroughness of the CFIUS review process when discussing the contentious deal. The administration emphasizes that while investments are crucial for economic growth, they must be balanced with security considerations to safeguard American interests.

Legal Challenges and Industry Implications

Despite the legal challenges posed by U.S. Steel and Nippon Steel against the Biden administration’s directive, this delay serves as a crucial reprieve for the entities involved. The companies are asserting that the decision made by CFIUS and the administration was biased—claiming that it undermined their right to an impartial evaluation. They seek judicial intervention to overturn what they perceive as an unjust ruling, aiming to secure a new opportunity for the merger.

The implications of this deal are significant not just for the companies involved, but also for the broader steel industry in America. U.S. Steel, a prominent player in the sector, sees the integration with Nippon Steel as a potential pathway to innovation, increased production efficiency, and a stronger market position. The outcome of this acquisition could set a precedent for future foreign investments in critical industries, shaping the landscape of U.S. economic policy in the years to come.

The polarization surrounding this acquisition mirrors the broader political trends in the United States where both Democratic and Republican leaders express concerns about foreign ownership of domestic firms. Biden and his predecessor, Donald Trump, have voiced skepticism regarding Nippon Steel’s proposal, motivated partly by the desire to garner support from labor unions that represent a crucial voting bloc. Such bipartisan concern illustrates the intricate relationship between politics and corporate dealings, particularly in sectors deemed vital to national security.

In this context of political maneuvering, statements from influential figures such as Japanese Foreign Minister Takeshi Iwaya add complexity. Iwaya’s regrets about the stalled transaction underscore the delicate balance between maintaining strong bilateral relations and addressing national security concerns within the United States. With Japan being a major investor in the U.S. economy, Iwaya’s comments indicate critical tensions that could arise from rejecting foreign investments, emphasizing the need for a pragmatic approach that addresses both security and economic collaboration.

While the extension until June 2025 offers some breathing room for Nippon Steel and U.S. Steel, the road toward a potential merger remains fraught with challenges. Legal battles could prolong the process further, while ongoing political debates about foreign investment may hinder the chances of reaching a resolution. Additionally, the position of labor unions and their opposition to the deal will continue to be a formidable hurdle, as demonstrated by the United Steelworkers’ backlash against the acquisition.

Ultimately, the acquisition bid encapsulates a myriad of issues, from national security to international relations, and the implications of its outcome could reverberate across both the steel industry and the broader U.S. economic landscape. As the deadline approaches, the eyes of stakeholders, politicians, and industry leaders alike will remain firmly fixed on the evolving narrative of this contentious corporate tussle. Only time will reveal whether this deal can withstand the scrutiny or whether it will fade into the annals of failed mergers.

Leave a Reply