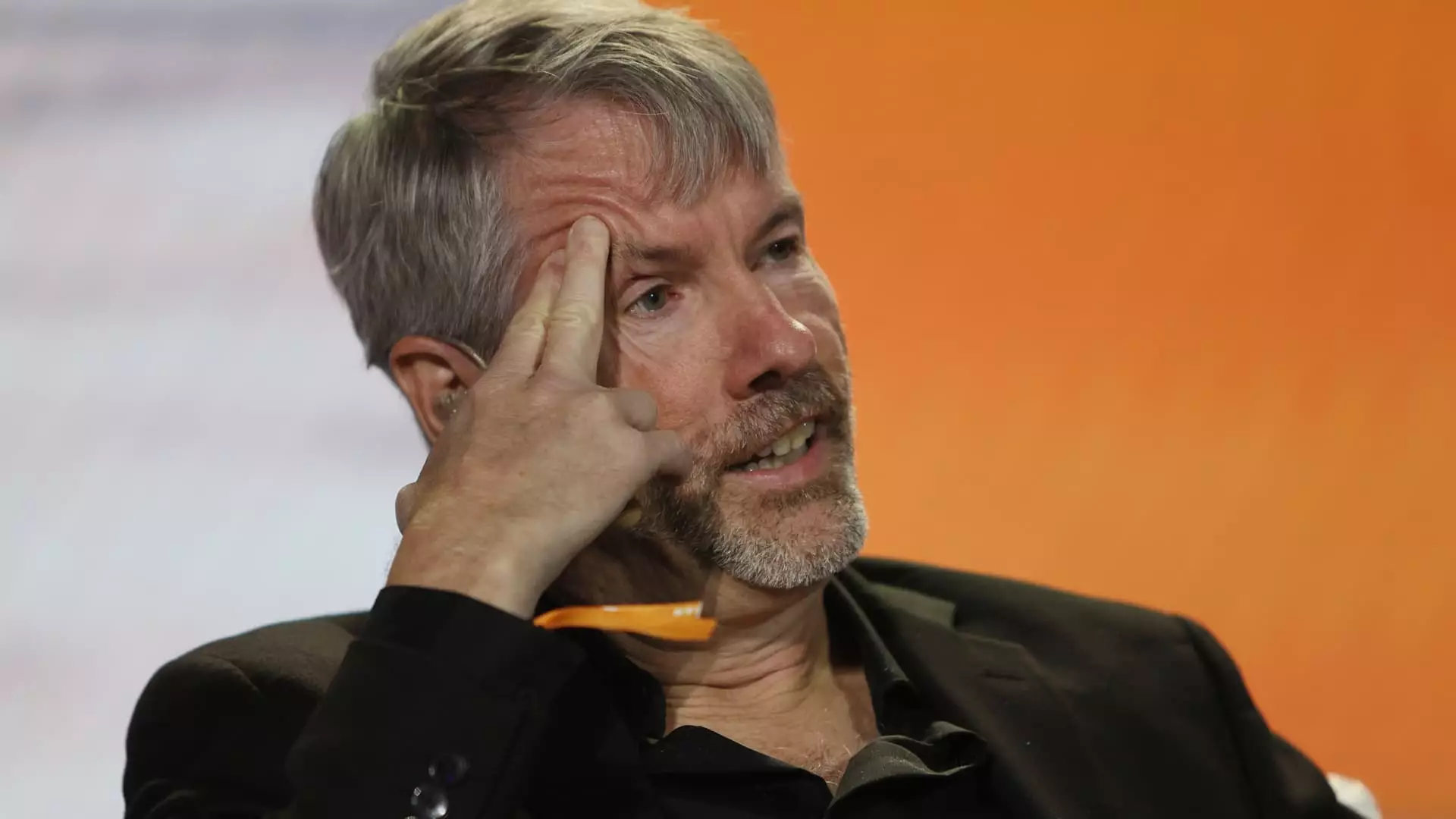

The cryptocurrency market often polarizes opinions within the financial ecosystem, igniting debates over investment strategies and risk management. In this landscape, Michael Saylor, a prominent figure and billionaire bitcoin investor, has aggressively championed the idea of integrating bitcoin into corporate financial strategies—most notably attempting to sway Microsoft, a behemoth in the tech industry, to follow suit. While Saylor’s enthusiasm is evident, his recent proposal at Microsoft’s annual shareholder meeting faced a resounding rejection, revealing the hurdles that traditional corporations encounter when contemplating a shift towards cryptocurrency investment.

Saylor’s aggressive advocacy for bitcoin represents more than personal financial interest; it’s a strategic vision positioned in contrast to conventional business models. Through his company, MicroStrategy, Saylor orchestrated a dramatic pivot from standard software operations to a dedicated investment strategy focused on bitcoin, evidenced by a staggering increase in MicroStrategy’s stock price—up nearly 500%—since his initial foray into bitcoin. His assertion that “Microsoft can’t afford to miss the next technology wave, and bitcoin is that wave,” articulates a fervent belief that cryptocurrencies will be a critical driving force behind future technological advancements.

Saylor’s persuasive tactics included a visually compelling presentation that underscored bitcoin’s superior historical returns compared to traditional assets like Microsoft stock and the S&P 500. The stark contrast he presented raised eyebrows, as it suggested a potential for significantly higher returns that could redefine corporate finance. His mantra champions the transformative potential of bitcoin, arguing for a shift in how companies manage cash flows and investments.

Despite Saylor’s impassioned plea, Microsoft shareholders voted against the proposal to consider bitcoin as part of the company’s financial strategy. The response can be interpreted as a reflection of the company’s longstanding cautious approach towards emerging technologies. Microsoft has previously monitored trends in cryptocurrencies, yet its reserved stance has prevented it from fully engaging with the market. Historically, corporations have faced scrutiny when investing in highly volatile assets, as demonstrated by the muted response from prominent proxy advisory firms like Glass Lewis and Institutional Shareholder Services, which recommended that shareholders vote against Saylor’s proposal.

Microsoft has substantial liquidity—over $78 billion in cash and equivalents. However, its management remains wary of the inherent risks associated with such a volatile asset class as bitcoin. The lack of consensus among shareholders can be seen as a broader message within corporate governance: the need for balancing innovative opportunities against traditional risk metrics and the responsibilities to shareholders.

Saylor’s relentless push for bitcoin adoption in corporate America brings to the forefront critical questions about the role of cryptocurrencies in modern finance. On one hand, the transformative allure of bitcoin as a major asset class represents a potentially lucrative opportunity for companies willing to embrace innovation. Yet, the volatility and regulatory uncertainties surrounding cryptocurrencies act as deterrents to corporate adoption, making it imperative for businesses to weigh risks meticulously.

Saylor’s argument for converting cash flows and dividends into bitcoin—a strategy he asserts could inflate stock prices significantly—poses an intriguing possibility. However, businesses must also consider how such strategies align with their long-term visions and operational risk profiles. The financial landscape is in constant flux, and while Bitcoin may offer substantial returns, the unpredictable nature of its fluctuations necessitates a nuanced approach.

The Future of Corporate Investment and Cryptocurrency

With Bitcoin’s value soaring and the market repeatedly challenging traditional financial paradigms, corporate leaders must consider the lessons from Saylor’s experiences with MicroStrategy. As of recent evaluations, MicroStrategy holds over 423,650 bitcoins, valued significantly higher than at their initial purchase—a testament to potential rewards residing within the volatile cryptocurrency space. However, companies weighing similar paths must also remain conscious of their responsibilities to shareholders and the need for prudent financial management.

The intersection of cryptocurrency and corporate investment is still fraught with challenges, as evidenced by Microsoft’s recent shareholder vote. Michael Saylor’s fervent advocacy shines a light on both the opportunities and the obstacles that lie ahead for companies considering a leap into the cryptocurrency realm. As the debate continues, the balance between innovation and risk will undoubtedly shape the future of corporate finance in an increasingly digital world.

Leave a Reply