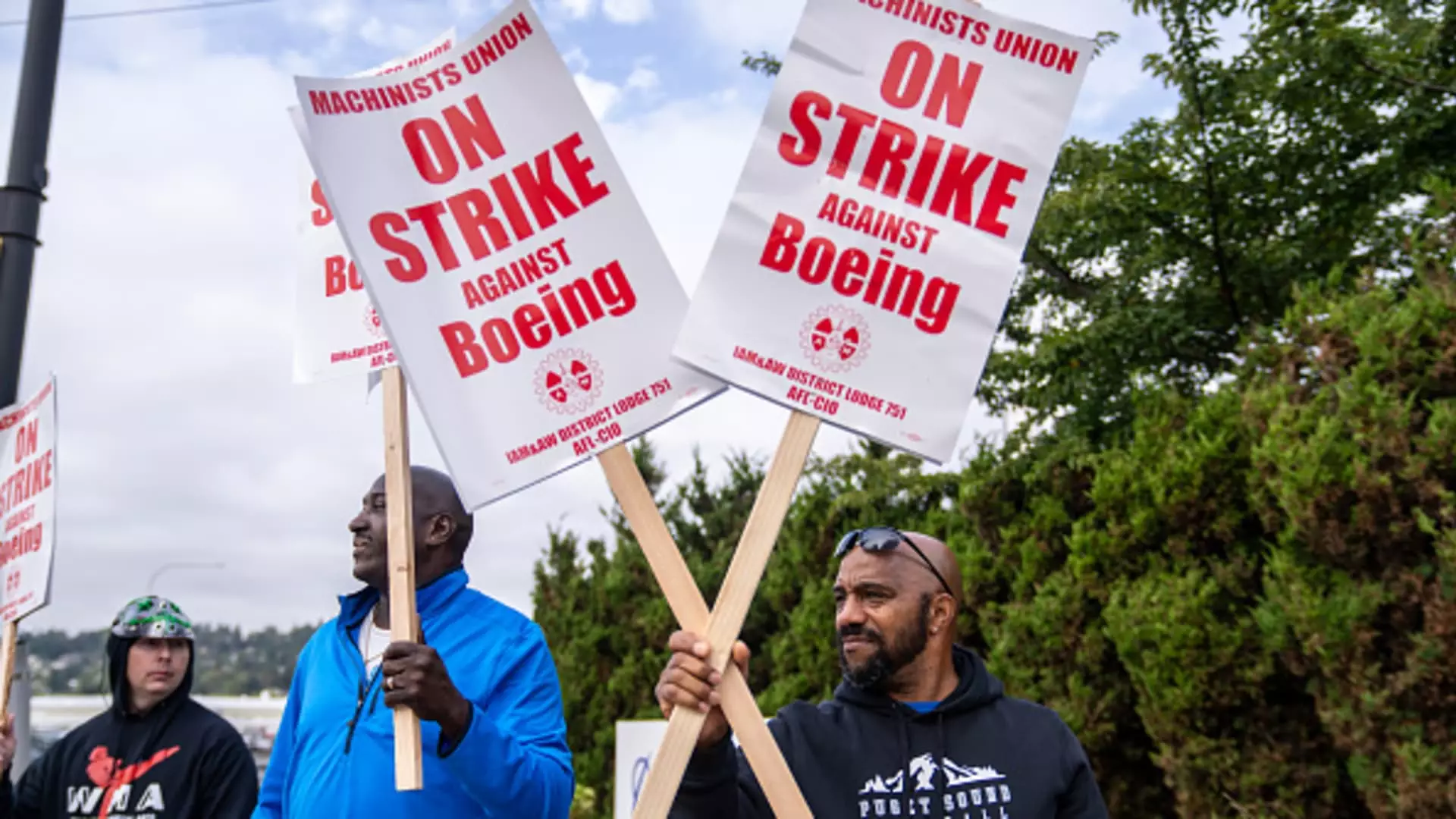

In recent weeks, Boeing has faced a significant crisis that has escalated tensions between the company and its workforce. More than 30,000 machinists have gone on strike after decisively voting against a proposed contract. The ramifications of this labor dispute are substantial, with estimates from S&P Global Ratings suggesting a staggering cost of over $1 billion per month to the company. This strike is not happening in a vacuum; rather, it follows a tumultuous period that has seen Boeing grappling with safety concerns, financial losses, and internal restructuring. The situation emphasizes the vulnerabilities facing one of the world’s leading aerospace manufacturers.

Boeing’s new CEO, Kelly Ortberg, finds himself under immense pressure to navigate this crisis effectively. Appointed amid ongoing troubles within the firm, Ortberg’s leadership is being tested as he attempts to restore confidence in the company’s operations and financial health. His approach has been scrutinized, particularly as the complexities of labor negotiations unfold. Initially optimistic conversations about rectifying labor relations have faltered, leading to a deadlock that places significant strain on the company’s output and cash flow.

The strike has not only halted aircraft production in Boeing’s factories but has also created ripple effects in the broader aerospace supply chain. With production stalling, workers are left without pay and health insurance, magnifying the urgency of finding a resolution. The reality on the ground emphasizes that resolving the labor strike is critical, not only for the thousands of machinists involved but for Boeing’s operational vitality.

The negotiations between Boeing and the International Association of Machinists and Aerospace Workers have become increasingly fraught. Key demands from the union, including the reinstatement of pension plans, have not gained much traction in discussions. Union President Jon Holden has advocated for a more constructive negotiation process, urging Ortberg to adopt fresh tactics rather than relying on traditional methods that have historically been met with resistance. The union’s commitment to representing its members’ needs indicates a strong resolve to achieve a contract that elevates worker conditions, while also showcasing the complexities of negotiating in a historically charged labor environment.

Unfortunately, the lack of a viable offer from Boeing has led to heightened frustration. The withdrawal of a previously enhanced contract proposal, described as “not negotiated,” illustrates the rising tensions and the potential for an extended strike, forecasted to last several more weeks. Analysts suggest that the reluctance from Boeing to meet union demands may further alienate its workforce, compounding the issues they face with production delays and financial instability.

Financially, Boeing is navigating a precarious situation. Recent announcements reveal a concerning trajectory, with losses expected to reach nearly $10 per share for the third quarter and anticipated charges close to $5 billion. This alarming financial outlook has not only spurred the need for drastic measures like workforce reductions—amounting to a planned 10% global cut—but also raises questions about the company’s long-term viability and strategy.

A disturbing trend exists where losses continue to mount without a clear path to profitability. With projections indicating that Boeing hasn’t had a profitable year since 2018, the current labor crisis could further entrench this cycle of financial hardship. Investors are now watching closely as Ortberg will soon face them during earnings reports, where the stakes are high given his recent leadership tenure.

Investor sentiment has evidently soured, with Boeing shares plummeting by 42% in the current year—marking the steepest decline since 2008. Analysts are also placing increasing pressure on Boeing to streamline operations and reduce expenditures in this bleak financial climate. Bank of America analysts have painted a grim picture, identifying ongoing challenges in quality, labor relations, program execution, and cash flow that create a “continuous doom loop.”

The strike at Boeing could also have far-reaching implications for its suppliers, some of whom may consider furloughs or layoffs in response to curtailed production. This interconnected web of relationships in the aerospace industry underscores the potential for Boeing’s challenges to impact a broader spectrum of economic activity.

As Boeing grapples with both labor unrest and financial uncertainty, the path forward remains uncertain. Achieving a resolution to the strike will be pivotal not just for the company’s operational capabilities, but for restoring trust among stakeholders and investors. Ortberg’s leadership will be critical in these negotiations, as the company seeks to balance immediate labor requirements with long-term financial sustainability. Whether Boeing can emerge from this intricate web of challenges and reestablish its position as a leader in the aerospace sector is a question that will likely dominate discussions in the months to come.

Leave a Reply