In a significant maneuver that illustrates the complexities of leadership in the energy sector, Warren Buffett has taken full control of Berkshire Hathaway Energy (BHE). Previously, Berkshire had a majority stake in the utility giant since 1999, but the decision to acquire the remaining 8% signals both opportunity and uncertainty. The deal, involving a hefty $2.37 billion in cash, alongside $600 million in debt and a considerable number of Class B shares, suggests that the company is navigating a complicated landscape.

BHE’s integration into Berkshire has not been without difficulty; indeed, it has served as a drag on the conglomerate’s otherwise robust performance. Analysts and investors have raised red flags regarding BHE’s valuation following the transaction, pointing to the turbulent backdrop that includes liabilities stemming from disastrous wildfires. This apprehension underlines a broader concern within the investment community regarding the future viability of utility investments in increasingly precarious conditions.

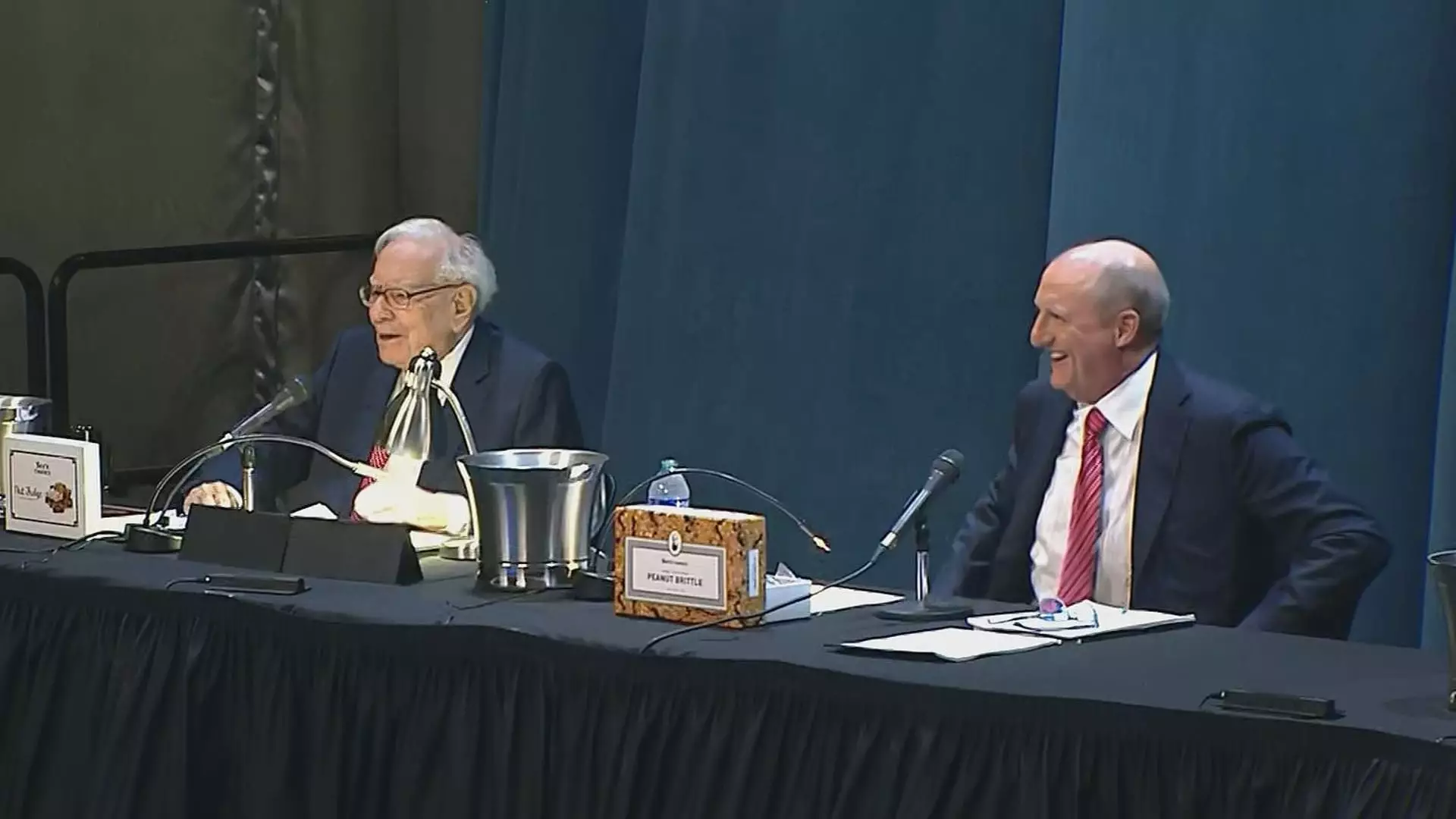

The valuation at which Buffett acquired the remaining stake in BHE does not reflect a premium, a detail that fuels skepticism among financial analysts. Bill Stone, the chief investment officer at Glenview Trust Company, highlighted this skepticism, suggesting that Buffett’s approach communicates lingering doubt about the utility company’s potential for recovery and growth. The troubling history of BHE’s financial strains, exacerbated by harsh regulatory conditions, complicates the assessment of this acquisition as a strategic expansion.

Buffett’s longtime confidant, Greg Abel, recently sold his 1% share in BHE for $870 million—something that underscores the perceived disconnect in valuation over a relatively short period. Abel, now the chairman of BHE, once enjoyed a brighter outlook on the company, a stark contrast to Buffett’s current reservations expressed in his latest annual letter.

The sobering reality for BHE stems from numerous factors outside its control. In his 2023 annual letter, Buffett acknowledged the “costly mistake” made in overlooking the ramifications of regulatory returns. His candid approach reveals a sense of caution that sharply contrasts the classic optimism typically associated with investing in the utility sector. The increased volatility triggered by wildfires has established a bleak narrative that may redefine how utility investments are perceived.

Buffett’s assertion that the utility industry might face prolonged periods of low profitability—or even bankruptcy—has significantly reshaped perspectives within Berkshire and beyond. Utility companies, once considered steady investments, are now grappling with an unpredictability that poses risks uncharacteristic of their historical performance.

Despite these obstacles, Berkshire Hathaway as a whole remains a powerhouse, recently achieving a market cap of $1 trillion—the first non-tech company ever to reach this milestone. However, the contrast between this achievement and BHE’s struggles is stark. Analysts like Cathy Seifert of CFRA Research highlight the tension between Berkshire’s broader success story and the burden presented by its utility arm.

While Buffett’s full acquisition of Berkshire Hathaway Energy might project an image of control, the realities of the utility sector render this prospect fraught with challenges. As the landscape continues to evolve, both investors and executives will be keenly watching how Berkshire navigates these turbulent waters, facing the dual pressures of industry unpredictability and lingering concerns about profitability.

Leave a Reply