The winter months often pose significant challenges for the elderly, especially in regions like the United Kingdom where harsh weather can exacerbate financial difficulties. Recent government decisions to limit crucial financial support for pensioners have raised alarming concerns among elderly citizens and advocacy groups alike. This article explores the emotional and practical implications of the recent government’s decision to restrict winter fuel allowances, focusing on the voices of those most affected, such as Kevin McGrath, an elder who feels a deep sense of injustice regarding these changes.

Voices of Concern

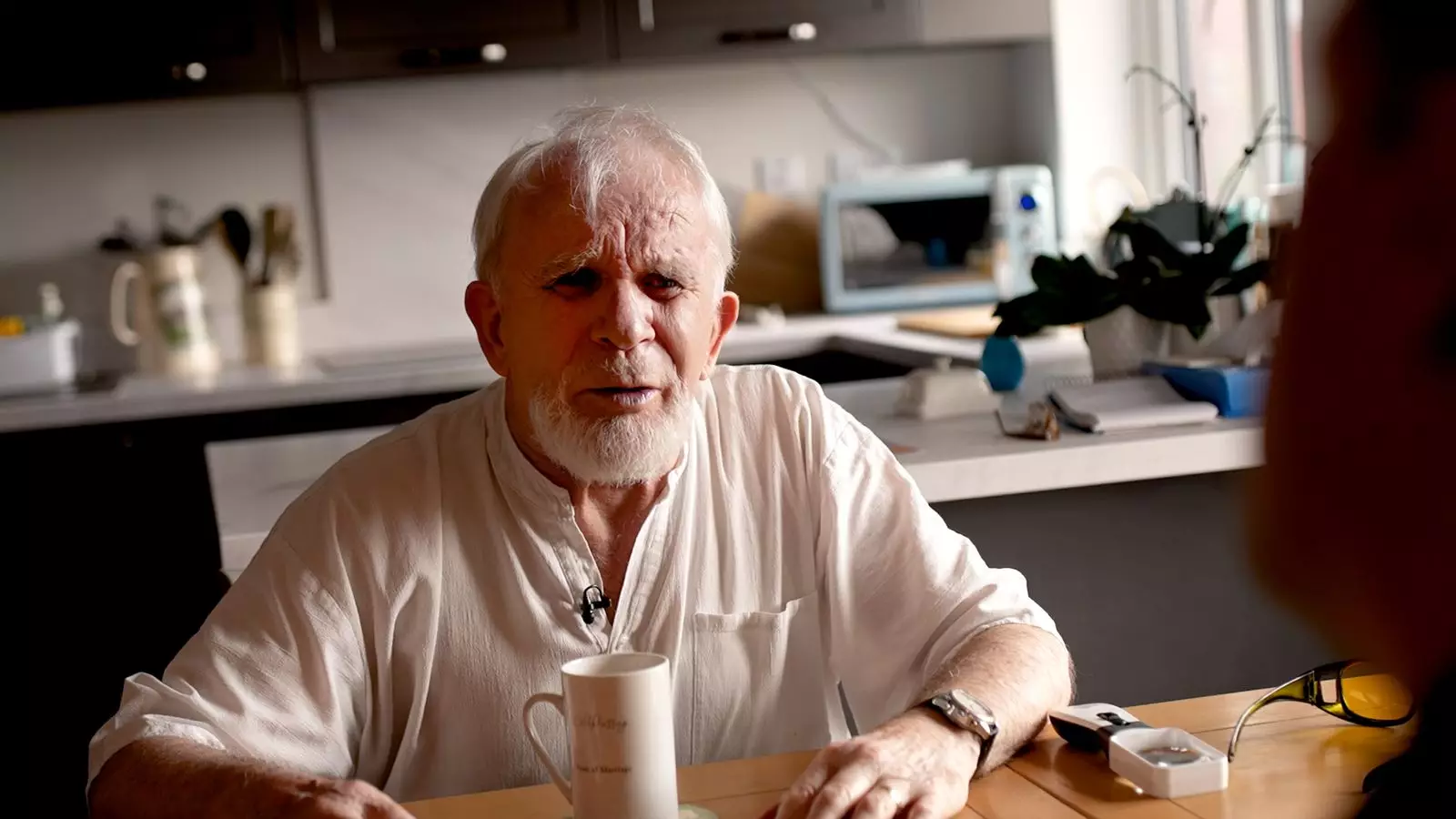

At 81 years old, Kevin McGrath embodies the concerns of many senior citizens grappling with the implications of recent policy changes. A former Roman Catholic monk turned social worker, McGrath has dedicated his life to uplifting others, and his frustration with government policies that target vulnerable populations is palpable. His recent eye surgery has only intensified his feelings as he recovers while worrying about the upcoming winter.

The decisive policy shift introduced by Chancellor Rachel Reeves involves withdrawing the winter fuel payment from millions of pensioners unless they qualify for Pension Credit or other means-tested benefits. This decision affects over 10 million elderly citizens in England and Wales, implementing a harsh financial reality for those who rely solely on state pension income. Rather than starting reforms from the top financial tiers, McGrath argues that focusing on the most vulnerable is morally indefensible. “It’s evil. It’s a crime,” he stated, highlighting the treacherous nature of targeting low-income pensioners for budget cuts.

One of the most distressing aspects of this policy change is the means-testing that elderly citizens like McGrath must undergo to determine their eligibility for continued support. This bureaucratic hurdle is not just a financial barrier but also an emotional one; many elderly individuals feel a sense of shame in having to prove their financial status to retain what has been a lifeline. “Who decides that we haven’t got enough money to live on?” he asks, conveying the indignity faced by those who have contributed to society through years of labor.

This concern is echoed by data from the charity Independent Age, which reveals a significant uptick in inquiries regarding pension credit—an essential factor for eligibility under the new framework. The data indicates that the volume of calls in August alone was three-and-a-half times higher than average for the initial half of the year, indicating rising anxiety about financial security among seniors.

Joanna Elson, chief executive of Independent Age, emphasizes that this policy shift disrupts the stability many elderly individuals rely upon during winter months. Reports of fear and uncertainty concerning food security, heating, and overall wellbeing have surged as seniors prepare for potentially overwhelming circumstances. For many, the thought of making drastic cutbacks looms large, highlighting their vulnerability.

Despite the government’s assurance that the average state pension will witness increases due to the continuation of the “triple lock” policy—ensuring pension rises in line with inflation, earnings, or a baseline of 2.5%—frequent calls for limiting benefits pose a significant contradiction. While the state pension may increase, the simultaneous removal of winter fuel payment threatens to negate those benefits, causing immediate and acute financial stress.

The sentiments echoed by individuals like Kevin McGrath expose a troubling trend in policy-making that prioritizes fiscal restraint over the welfare of vulnerable populations. As winter approaches, the question of whether the government has indeed prioritized the right groups—by cutting support for those in greatest need—remains a pressing concern. The implications of this decision stretch beyond individual lives and directly impact the fabric of community support and societal welfare.

Elders, who have contributed significantly throughout their lives, should not face a scenario where financial insecurity is compounded by government policy. Their voices should be heard and valued as we navigate the complexities of public finance. As winter approaches, the time for reassessment and responsiveness is now—there exists an urgent need for policies that provide comprehensive support rather than systemic exclusion of those who have contributed to society’s growth and resilience.

Leave a Reply