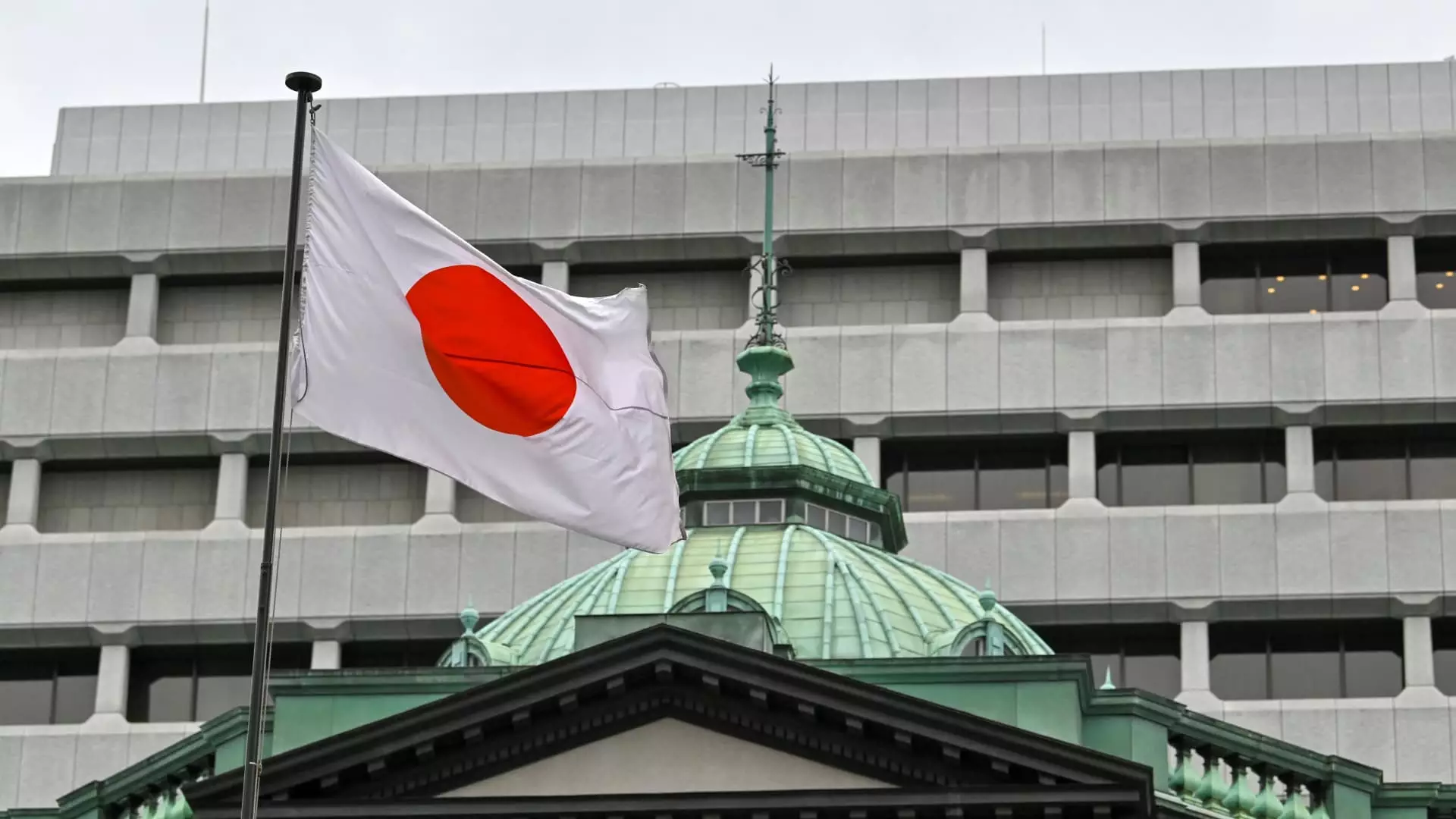

In a recent policy meeting, the Bank of Japan (BOJ) opted to maintain its benchmark interest rate at “around 0.25%,” marking the highest level viewed since 2008. This decision aligns with analysts from Reuters who had anticipated such a move, yet it raises questions about the future trajectory of Japan’s monetary policy. The BOJ’s cautious approach appears aimed at gradually normalizing its long-standing ultra-loose monetary policy. The challenge lies in balancing this transition without compromising the nation’s economic recovery.

Japan’s economy has displayed signs of moderate recovery, a sentiment echoed by the central bank’s recent statement. However, the BOJ cautioned that “some weakness has been seen in part,” indicating that despite the overall positive sentiments, challenges persist. Future growth forecasts suggest that the economy may continue to expand at rates exceeding its potential growth, attributed to a burgeoning cycle of income and spending dynamics. Nonetheless, the BOJ acknowledges that these optimistic projections must be tempered with caution as the global economic climate evolves.

One noteworthy aspect of the BOJ’s discourse is its projection that core inflation will climb through the fiscal year 2025. Such forecasts could provide the necessary impetus for the bank to continue its path of tightening monetary policy. Presently, Japan’s inflation rate – which excludes volatile food prices – has risen to 2.8% year-on-year, up from previous estimates, signaling an environment conducive to further rate increases. Economists are now mulling the implications of this inflation trajectory on consumer behavior and broader economic stability.

Following the BOJ’s decision, market reactions were notably subdued. The yields on 10-year Japanese government bonds saw minor fluctuations, dipping 0.4 basis points, while the yen remained stable against the dollar at approximately 142.52. The Nikkei 225 index stayed relatively steady, reflecting investor sentiment that is cautious but hopeful. Such indicators suggest a delicate equilibrium within Japanese markets as they digest the implications of the BOJ’s revised stance.

Interestingly, the BOJ has embarked on a path that contrasts sharply with other central banks worldwide. While the Federal Reserve in the United States opted for a rate cut, the BOJ remains committed to tightening its policies. This divergence places Japan in a unique position amidst a landscape of increasingly loose monetary policy approaches being adopted by various nations. Experts anticipate that BOJ might embark on further rate hikes in October, even in the face of soft economic data.

Stefan Angrick of Moody’s Analytics raises a crucial point about the potential risks associated with the BOJ’s policy direction. While rate hikes may be justified on the grounds of inflation management, they also carry the risk of acting as a drag on economic growth. The situation becomes even more delicate considering Japan’s revised second-quarter GDP growth figures were downgraded to an annualized 2.9%. This marks a softer recovery than initially expected, illustrating the complexities surrounding the nation’s economic outlook.

The BOJ now stands at a significant crossroads, where its decisions could have far-reaching implications for Japan’s economy and its citizens’ financial well-being. As it prepares to navigate these uncharted waters, balancing the need for monetary tightening against the imperative of maintaining economic momentum will be paramount. Observers and economists alike will be keenly watching how the BOJ’s actions unfold, particularly in the context of a changing global economic landscape marked by increasing uncertainty and divergent monetary policies. What Japan’s economic future holds remains uncertain, but it is undeniably tied to the careful calculations that will shape the BOJ’s upcoming decisions.

Leave a Reply