If former President Donald Trump were to secure a second term in office, the global economic landscape could be facing a resurgence of inflation. Analysts have expressed concerns over the potential inflationary effects of Trump’s America-first policies, which were prominent during his first term in office. The high tariffs and low tax economic agenda implemented by Trump could further drive up costs worldwide, leading to detrimental consequences for the global economy.

The “inflation mindset” that has persisted since Trump’s initial term could exacerbate the inflationary impact of his policies if he were to be re-elected in the future. This shift in perception towards inflation could influence price rises not only within the United States but also in regions like Asia and Europe. The imposition of high tariffs tends to be inflationary as it increases the costs of imported goods, allowing domestic producers to raise their prices, thereby burdening consumers with higher costs. Similarly, tax cuts can stimulate consumer spending, leading to an increase in the prices of goods and services.

Both President Joe Biden and Trump have indicated their intentions to raise tariffs on China amidst escalating geopolitical tensions between the two nations. Economists have predicted that inflation would likely rise under a second Trump term due to his staunch protectionist stance. On the other hand, an increase in inflation during a potential second Biden term could be attributed to large spending packages being proposed. The repercussions of higher inflation could extend to Asia, potentially posing a negative risk factor for stocks in the region.

Forecasts for Asia and Europe

Nomura’s Gareth Nicholson noted that a Trump presidency could have inflationary implications for the global economy and could accelerate supply chain shifts within Asia. In Europe, Goldman Sachs projected a 0.1 percentage point increase in inflation under a Trump administration due to higher tariffs impacting global trade. Manulife’s Marc Franklin suggested that Trump’s inclination towards tax cuts and revisiting Chinese tariffs could result in a reflationary mix, leading to rising inflation expectations and subsequently higher interest rates.

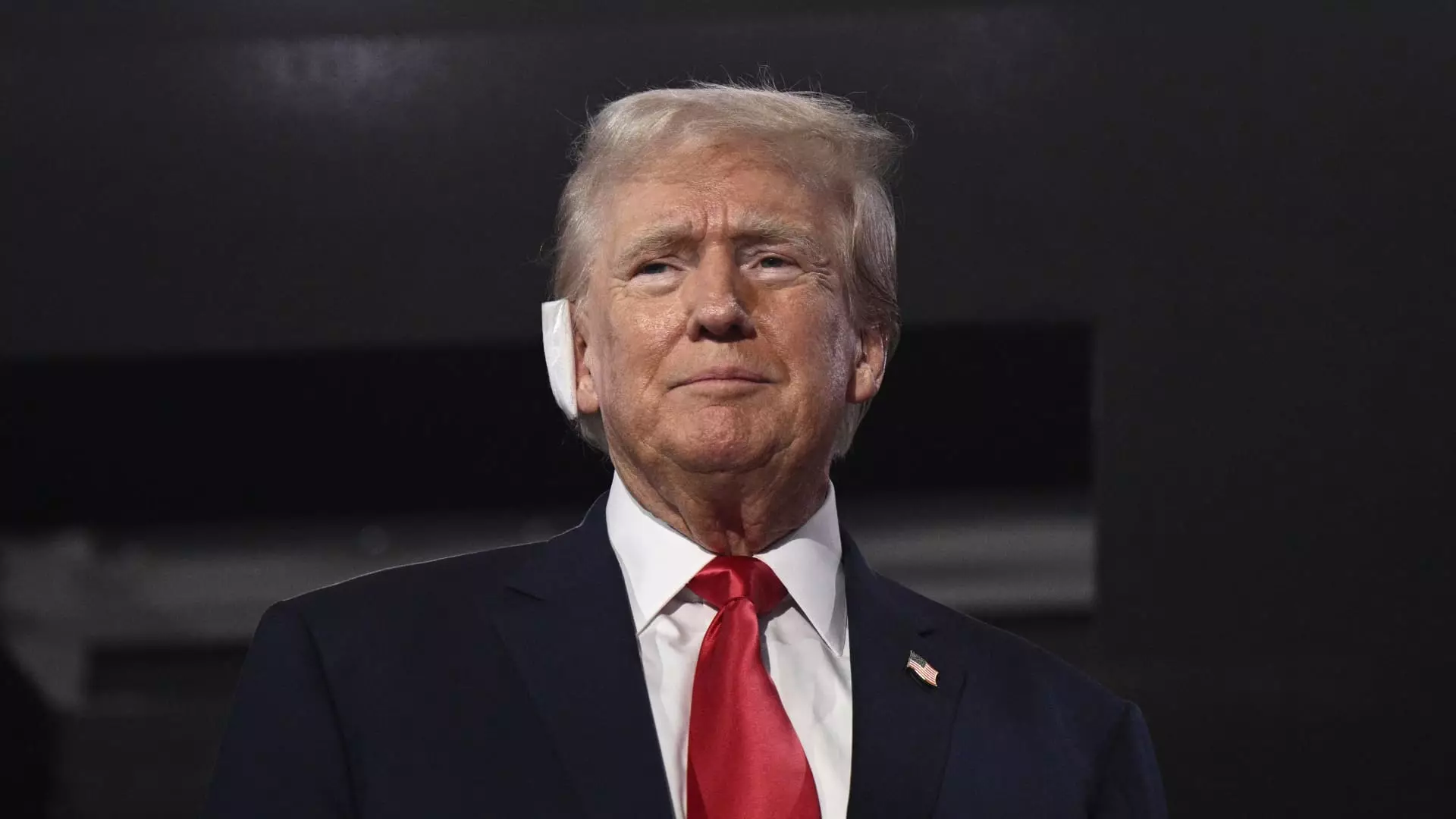

Despite facing challenges such as an assassination attempt and geopolitical uncertainties, Trump’s campaign for the presidency appeared to gain momentum. Investors reacted positively to the prospect of a pro-business Republican nominee, as evidenced by the surge in U.S. stocks. However, analysts cautioned that the rally spurred by Trump’s candidacy might be short-lived given the concerns surrounding his protectionist agenda and its repercussions on the global economy.

The potential impact of a second Trump term on global inflation is a matter of significant concern among analysts and economists. The inflationary consequences of Trump’s policies, characterized by high tariffs and low taxes, could lead to price hikes both domestically and internationally. The contrasting policy approaches of Trump and Biden towards trade and economic stimulus highlight the divergent paths that could be taken in addressing inflationary pressures. As the global economy navigates through uncertain times, the implications of political decisions on inflation and economic stability remain a key area of focus for policymakers and market participants alike.

Leave a Reply