Nvidia, a company long associated with producing graphics chips for the gaming community, has recently achieved a significant milestone by becoming the most valuable public company globally. The company’s market cap soared to an impressive $3.33 trillion, surpassing tech giants like Microsoft and Apple. The meteoric rise in Nvidia’s stock price, which has surged by over 170% this year, can be attributed to the increased demand for its chips used in data centers for artificial intelligence (AI) applications.

In recent years, Nvidia has established itself as a dominant player in the market for AI chips, capturing around 80% of the market share for data center chips. This surge in demand can be linked to the widespread adoption of AI technologies by tech giants such as OpenAI, Microsoft, Alphabet, Amazon, and Meta. As these companies race to develop AI models and handle massive workloads, the need for high-performance chips has increased significantly, benefiting Nvidia.

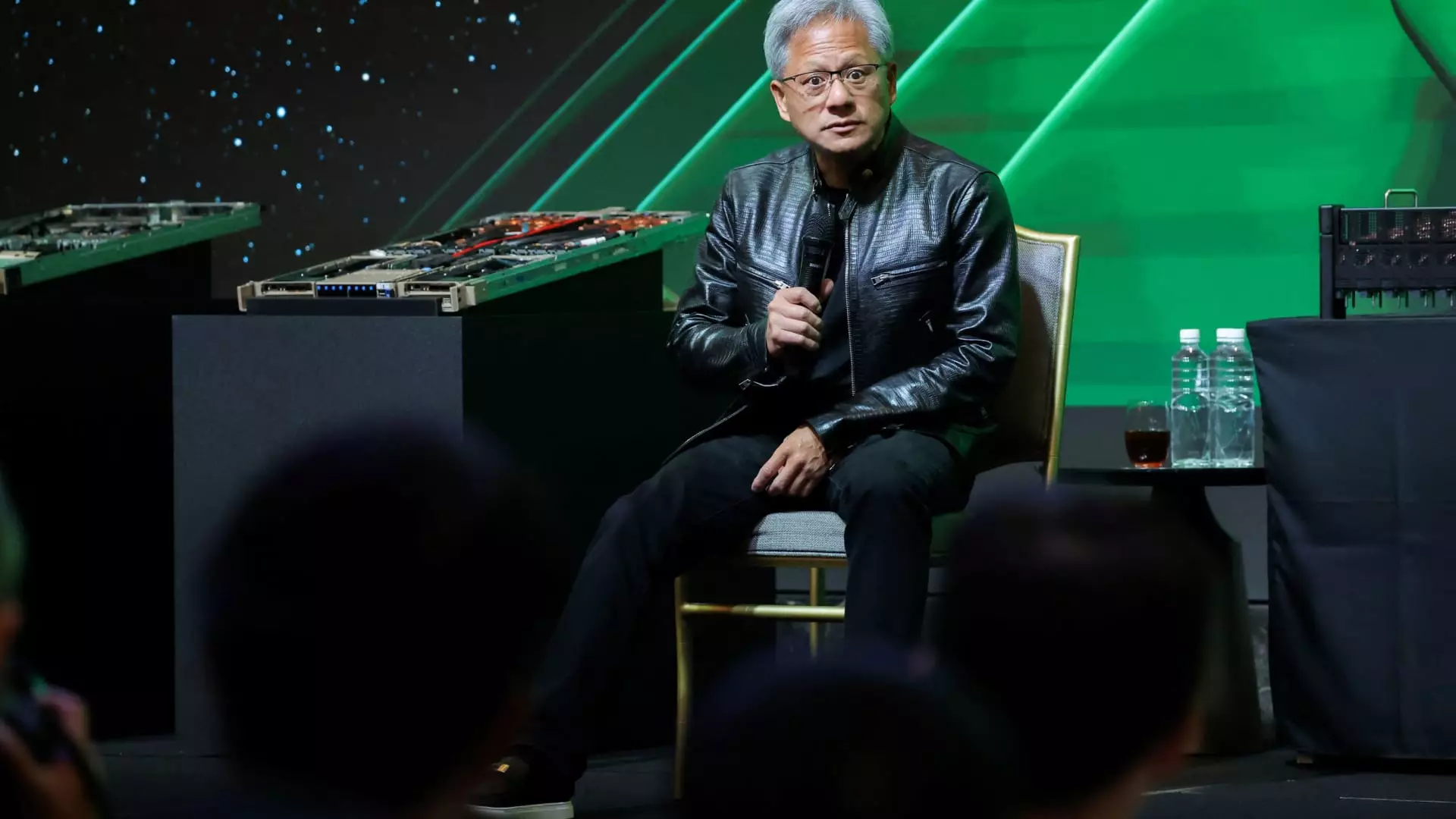

Founded in 1991, Nvidia initially focused on selling chips for gaming applications. However, the company’s strategic shift towards AI technologies in the past two years has paid off handsomely, as Wall Street recognizes Nvidia’s role as a key player driving the AI revolution. This transformation has propelled Nvidia’s stock price to new heights, making its co-founder and CEO, Jensen Huang, one of the wealthiest individuals globally, with a net worth of approximately $117 billion.

Despite Nvidia’s remarkable growth, tech behemoths like Microsoft and Apple continue to be major players in the AI and tech industry. Microsoft, in particular, has capitalized on the AI boom by integrating AI models from OpenAI into its flagship products like Office and Windows. The company’s strategic partnership with Nvidia for utilizing GPUs in its Azure cloud service has further solidified its position in the market.

The rapid ascent of Nvidia as the most valuable U.S. company has significant implications for the tech industry landscape. The company’s inclusion in the Dow Jones Industrial Average, a prestigious stock benchmark, is a testament to its growing influence and market capitalization. Nvidia’s recent decision to implement a 10-for-1 stock split reflects its ambition to appeal to a broader investor base and potentially enhance its chances of joining the Dow.

Nvidia’s remarkable journey from a niche gaming hardware company to a tech giant at the forefront of the AI revolution underscores the transformative power of technological innovation. As the demand for AI technologies continues to grow exponentially, companies like Nvidia are well-positioned to lead the charge in shaping the future of the tech industry.

Leave a Reply